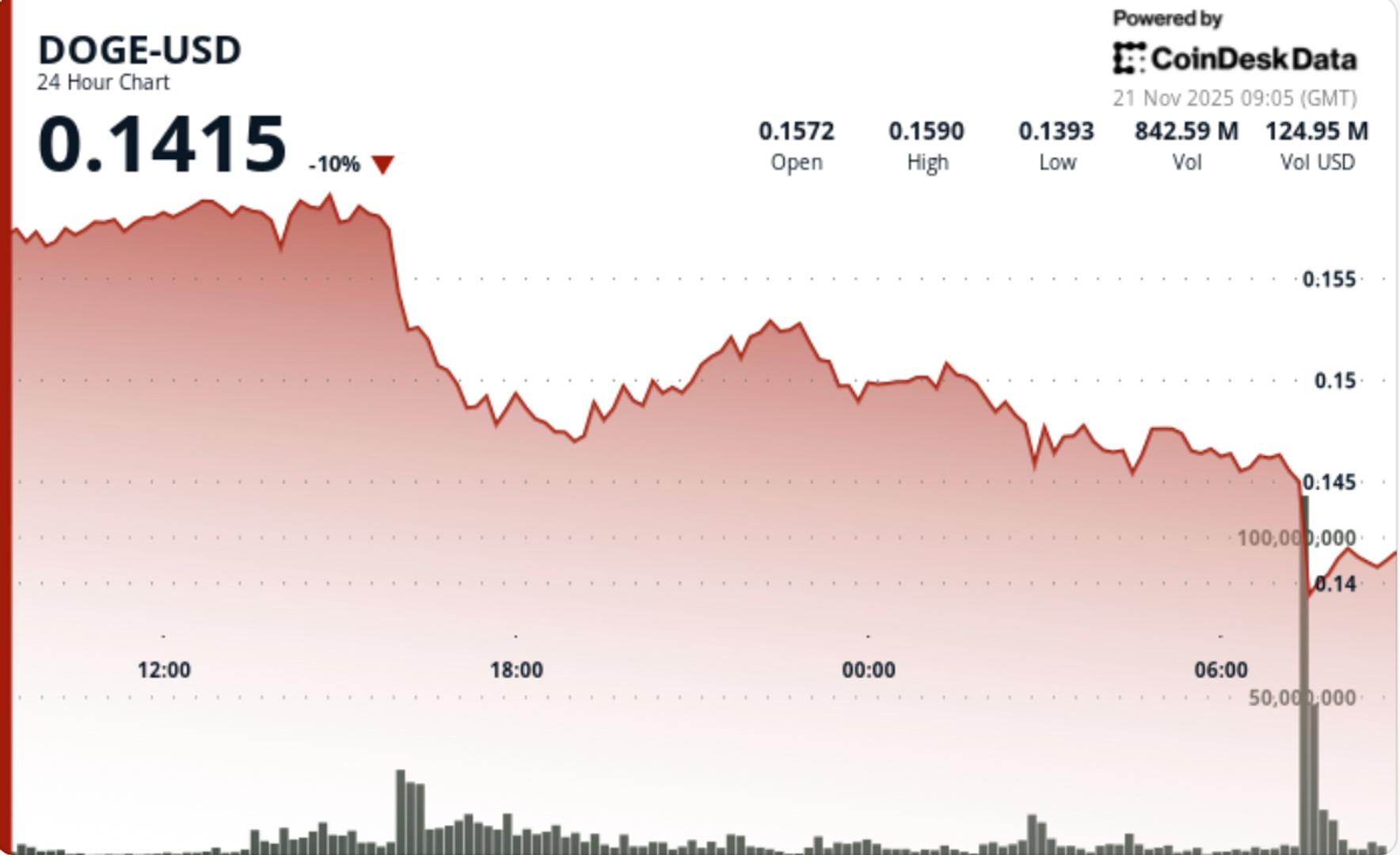

DOGE Chart Turns Fully Bearish After Multi-Level Support Failure

NegativeCryptocurrency

- Dogecoin has turned fully bearish after failing to maintain multi-level support, with technical indicators showing it is deeply oversold. The cryptocurrency is trading below its 50-day and 200-day moving averages, signaling persistent trend weakness.

- This development is critical as it highlights the challenges Dogecoin faces in regaining upward momentum, raising concerns among investors about its future performance in a volatile market.

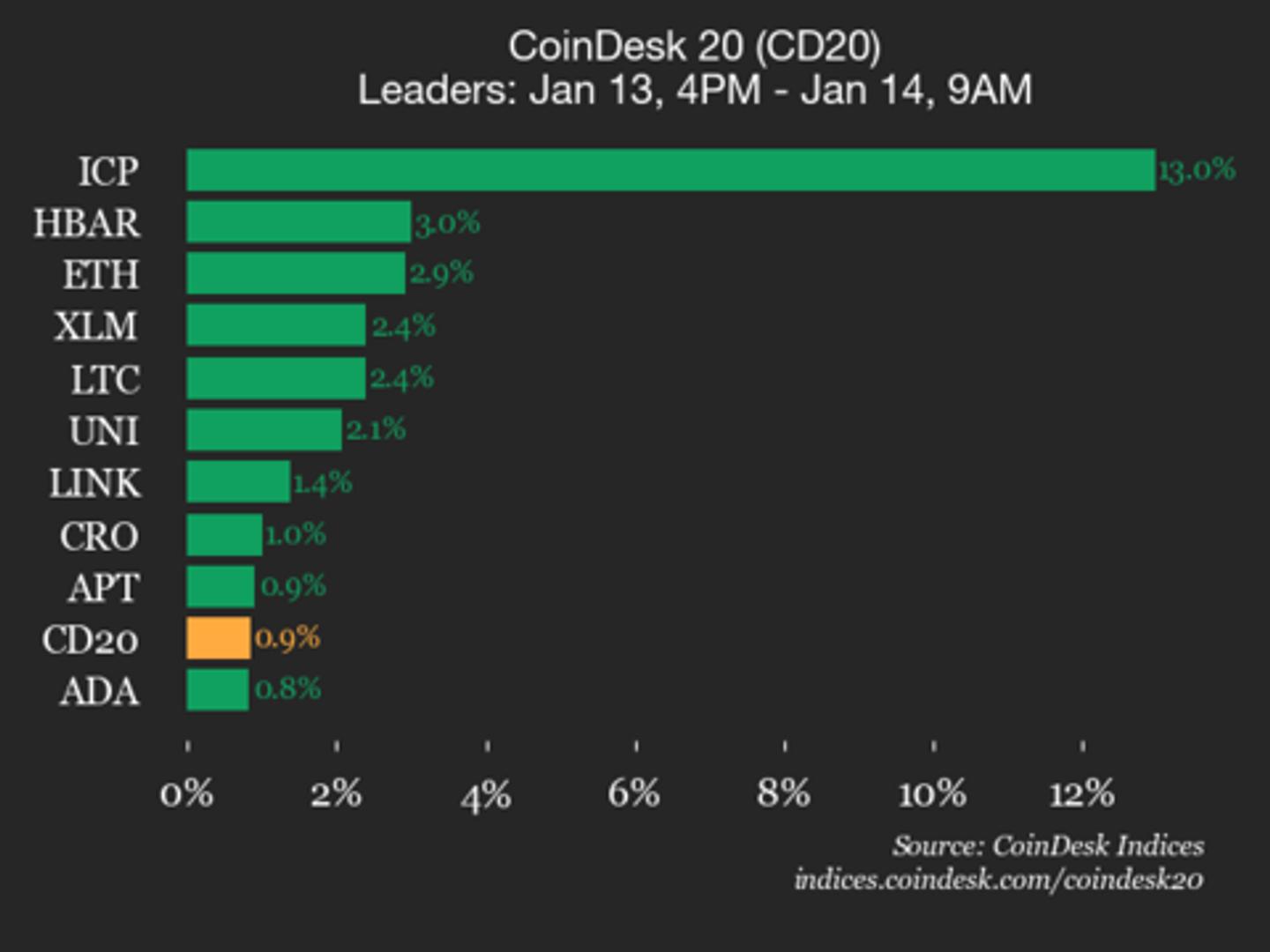

- The broader cryptocurrency landscape reflects similar bearish sentiments, with many digital assets experiencing downward pressure, influenced by market dynamics and seller demographics that are impacting prices across the board.

— via World Pulse Now AI Editorial System