Altcoin ETFs Slam $69M In Trading Volume As FOMC Set To Pump BTC USD Price

PositiveCryptocurrency

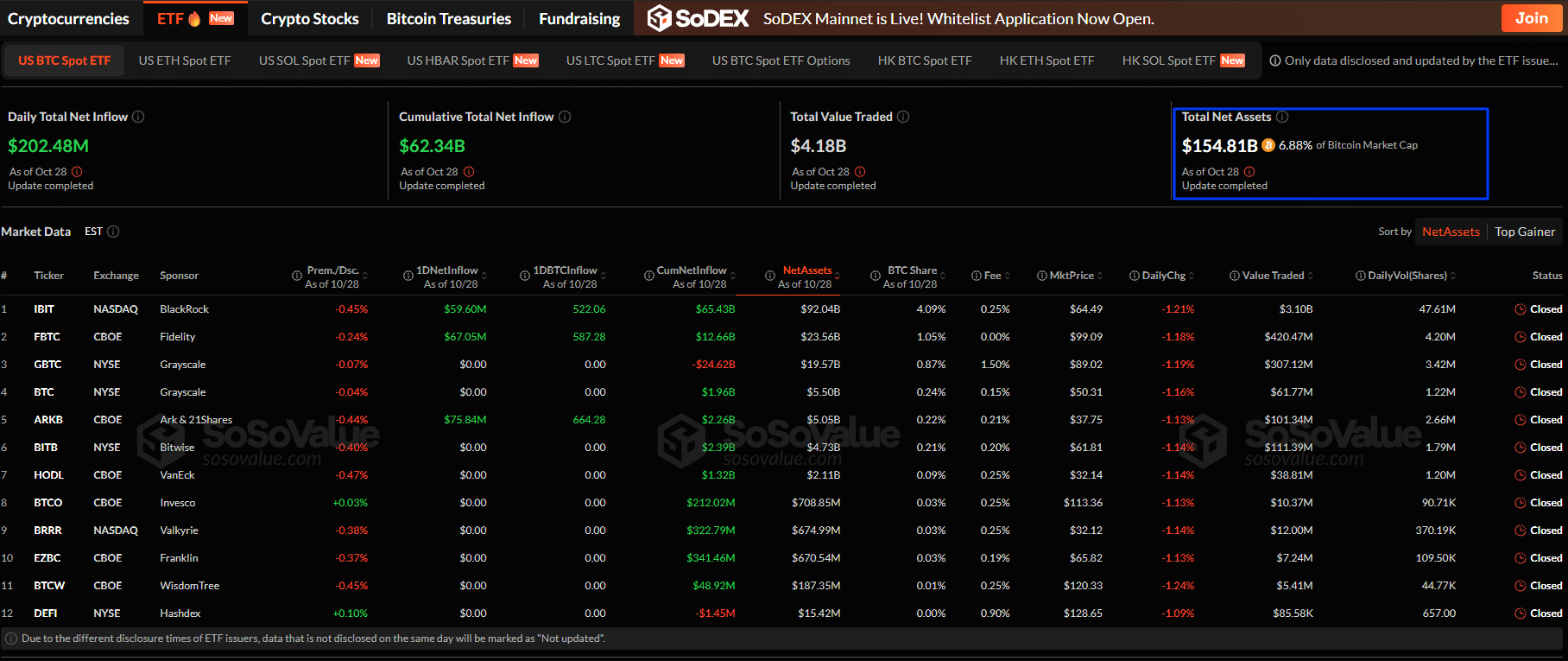

Altcoin ETFs have made a significant impact, achieving $69 million in trading volume as the Federal Open Market Committee (FOMC) is expected to influence Bitcoin's price. With Bitcoin now valued over $110,000 and a growing selection of altcoins in the market, this surge in trading activity highlights the increasing interest from mainstream investors. The evolving landscape of cryptocurrency is drawing attention, suggesting that as altcoins gain traction, they could play a crucial role in the future of digital assets.

— Curated by the World Pulse Now AI Editorial System