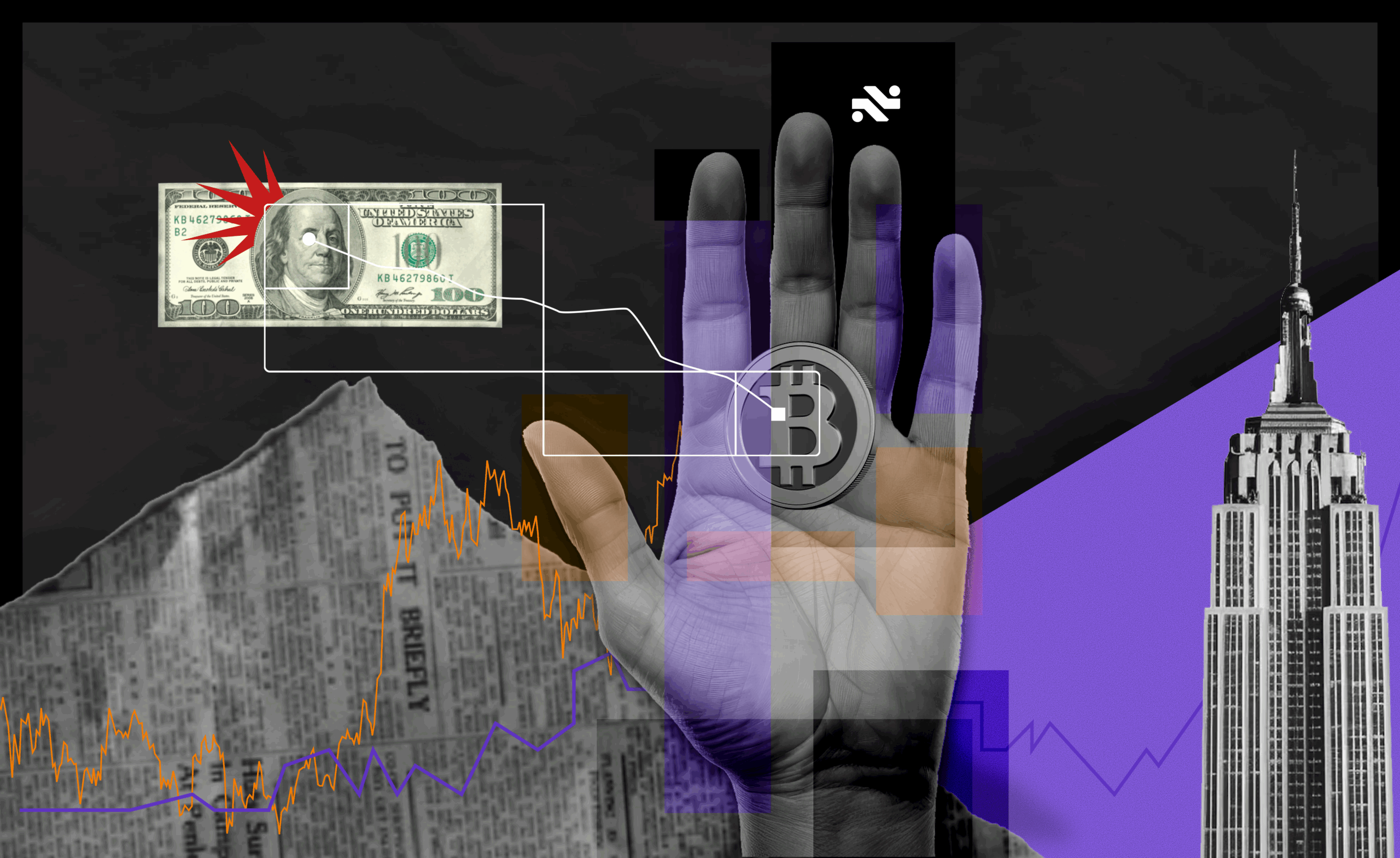

LayerZero price at risk ahead of $43M ZRO token unlock

NegativeCryptocurrency

LayerZero's price is facing challenges as traders prepare for a significant $43 million token unlock, which could lead to increased market volatility and test current support levels. Although the price is slightly up at $1.71, it remains down 11% overall. This situation is crucial for investors as it may influence future trading strategies and market sentiment.

— Curated by the World Pulse Now AI Editorial System

![[LIVE] Crypto News Today, October 20 – Why Is Crypto Up Today? Market Recovers as Bitcoin Reclaims $110K and Ethereum $4K: Best Crypto to Buy?](https://dummyimage.com/600x400/1a4a3b/ffffff.png&text=World Pulse Now)