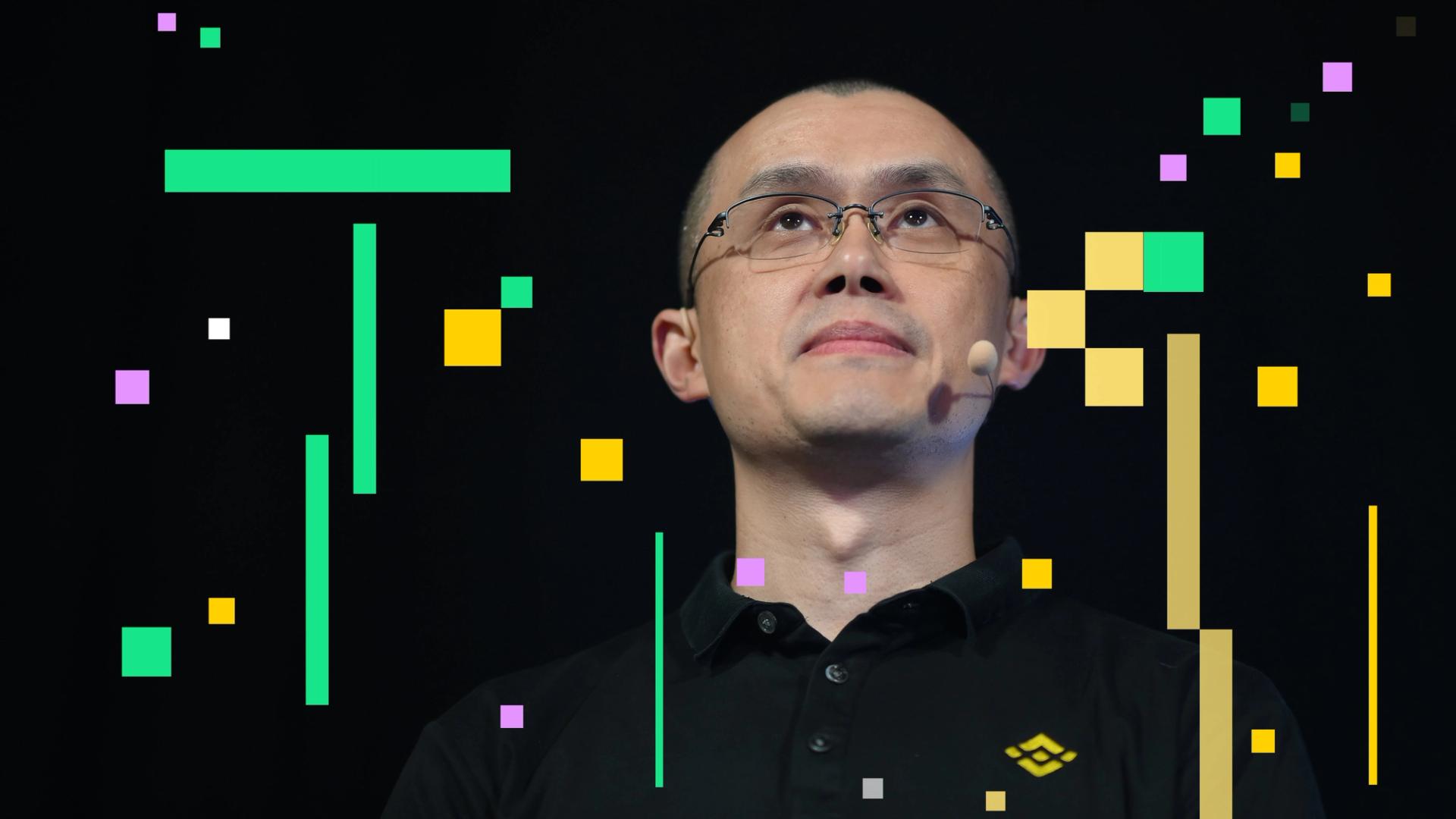

CZ Highlights Gambaryan Detention in Nigeria as Trump, US War Secretary Call for Action

PositiveCryptocurrency

CZ has brought attention to the detention of Gambaryan in Nigeria, a situation that has garnered support from prominent figures like Trump and the US War Secretary. This highlights the growing international concern over human rights and the need for accountability in such cases. The involvement of high-profile leaders underscores the importance of addressing these issues on a global scale, potentially leading to significant diplomatic actions.

— Curated by the World Pulse Now AI Editorial System