Ready From “Cointober?” Atkins Promises “Minimum Effective Dose” Of Regulation

PositiveCryptocurrency

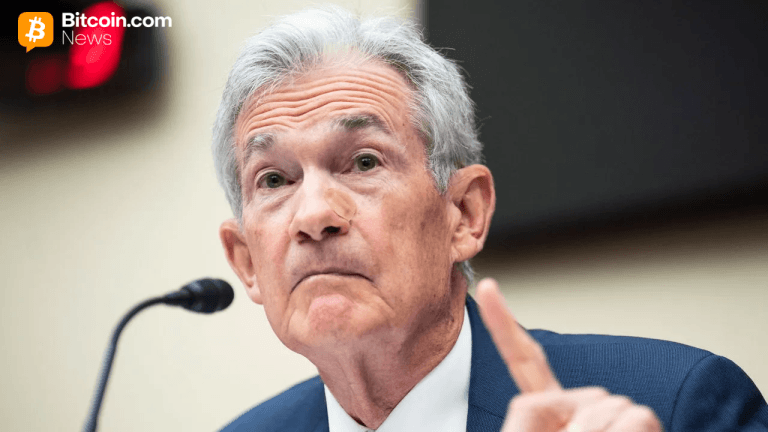

October is shaping up to be a pivotal month for the cryptocurrency markets, with high hopes for Federal Reserve rate cuts and crucial decisions on 16 pending spot crypto ETF applications by the US Securities and Exchange Commission. This could mark a significant turning point for investors and the industry, as the outcomes may influence market dynamics and regulatory approaches moving forward.

— Curated by the World Pulse Now AI Editorial System