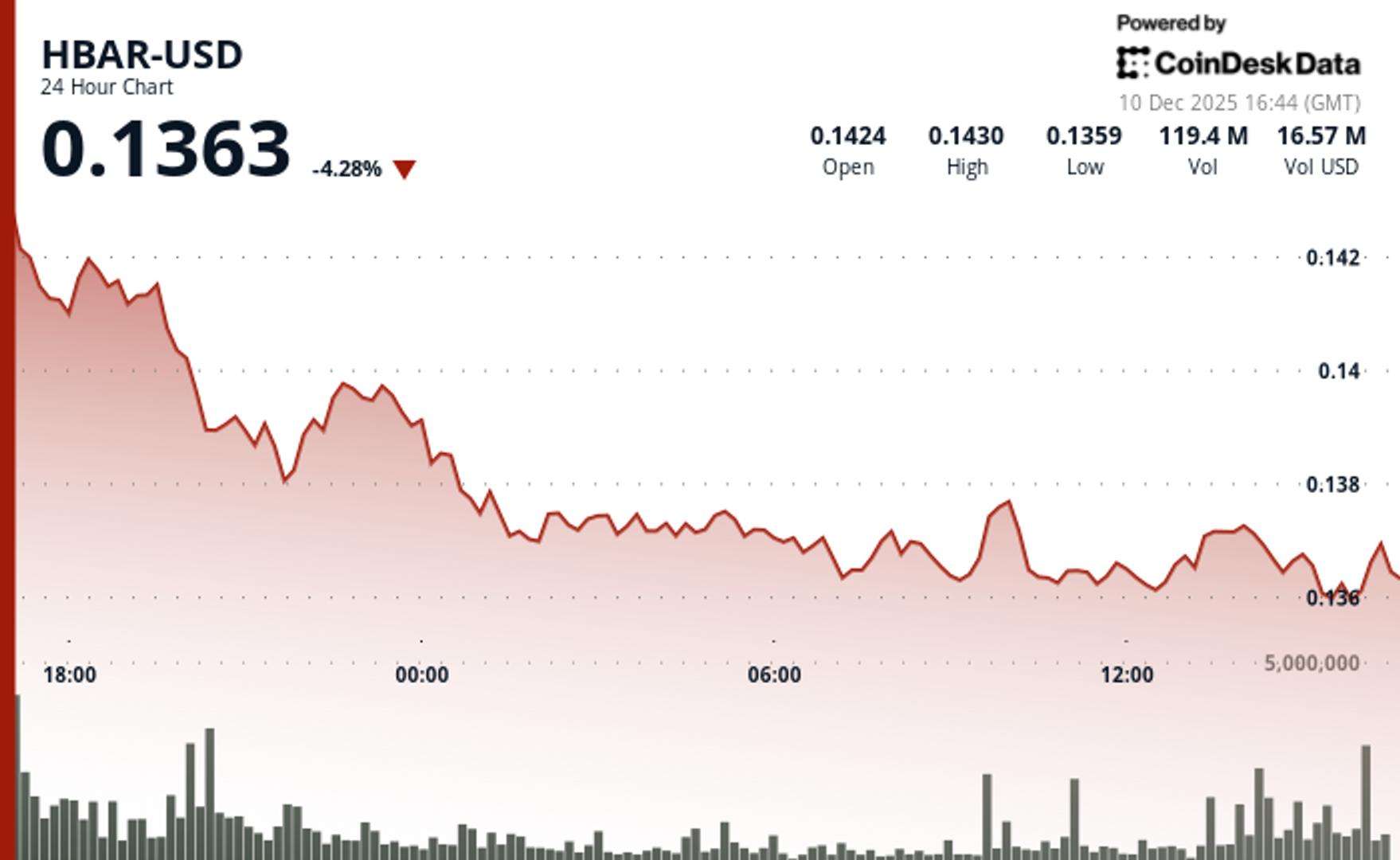

Hedera Rises 1.8% to $0.1372 as Government Adoption Momentum Builds

PositiveCryptocurrency

- Hedera's native token, HBAR, has increased by 1.8% to $0.1372, reflecting a period of technical consolidation and a renewed focus on enterprise tokenization initiatives. This rise comes amidst a backdrop of fluctuating market conditions, with recent reports indicating both gains and declines in the cryptocurrency sector.

- The uptick in HBAR's value is significant as it suggests growing investor confidence and interest in Hedera's blockchain technology, particularly in light of government adoption efforts and partnerships aimed at modernizing property rights management.

- This development highlights a broader trend in the cryptocurrency market where institutional interest is rising, as evidenced by Hedera's reinstatement in the Coinbase 50 Index and ongoing initiatives like the tokenization of real estate in Georgia. However, the market remains volatile, with fluctuations in other cryptocurrencies indicating a complex landscape for investors.

— via World Pulse Now AI Editorial System