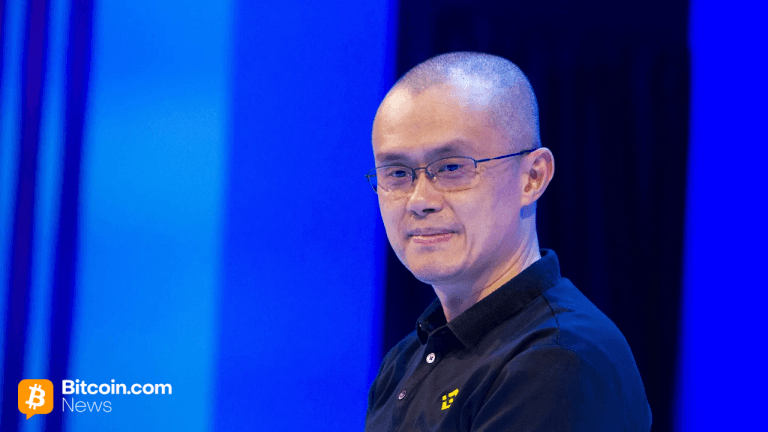

‘Digital gold’ thesis difficult to prove as real thing soars, Bitcoin stalls

NeutralCryptocurrency

Gold has seen a remarkable rise of 42.7% this year, driven by ongoing geopolitical tensions, while Bitcoin has lagged behind with a 20.7% increase. This disparity raises questions about the 'digital gold' narrative often associated with Bitcoin, as investors may be reassessing their preferences in uncertain times. Understanding these trends is crucial for investors looking to navigate the evolving landscape of digital and traditional assets.

— Curated by the World Pulse Now AI Editorial System