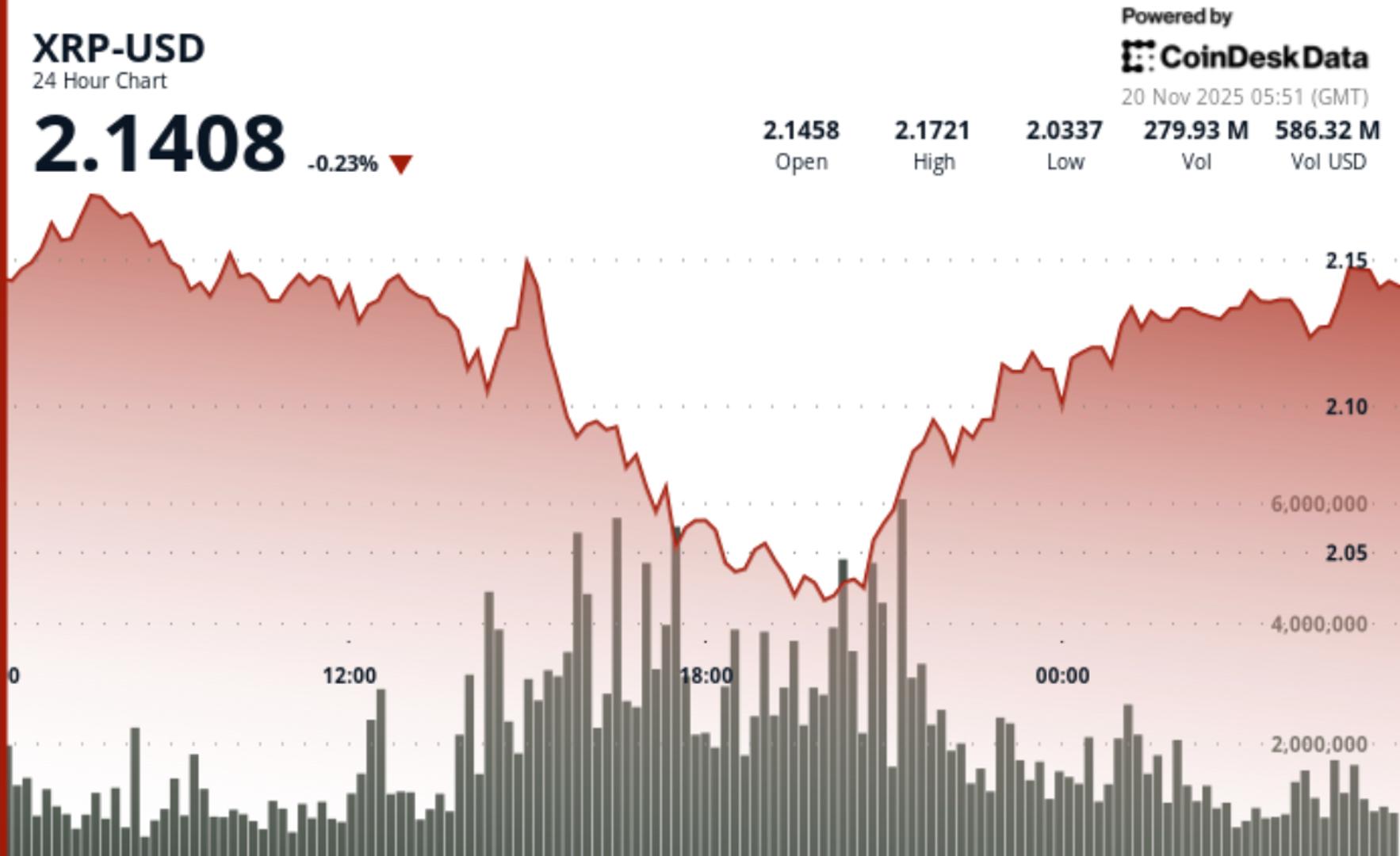

XRP Slumps as $2.15 Level Collapses, Bearish Structure Deepens

NegativeCryptocurrency

- XRP's price has slumped below the $2.15 level, reflecting a deeper bearish structure in the cryptocurrency market. The decline is linked to overall market weakness and Bitcoin's 'Death Cross', indicating potential further losses.

- This situation is critical for XRP as it has seen a significant drop in trading activity and investor confidence, with analysts warning of a possible 25% decline to $1.55 if current trends continue.

- The broader cryptocurrency market is facing volatility, with many assets, including Bitcoin and Bitcoin Cash, also trading lower, highlighting a pervasive trend of profit

— via World Pulse Now AI Editorial System