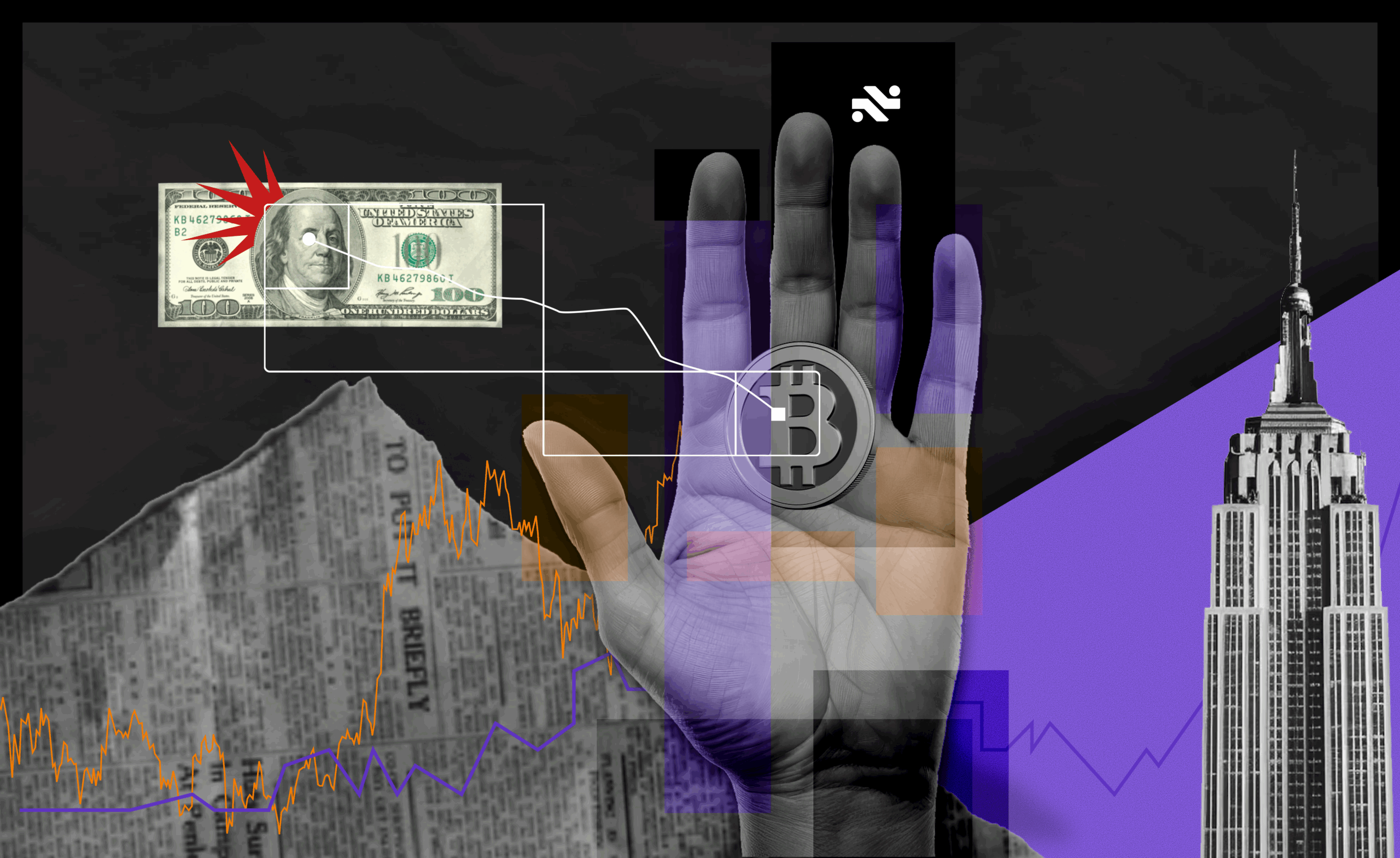

ECB Pits Digital Euro Against Stablecoins as the Battle for Money Supremacy Heats Up

NeutralCryptocurrency

The European Central Bank (ECB) is intensifying its efforts to introduce a digital euro, positioning it as a competitor to stablecoins in the evolving landscape of digital finance. This move is significant as it reflects the ECB's commitment to maintaining monetary sovereignty and adapting to the rapid growth of cryptocurrencies. As stablecoins gain popularity for their stability and ease of use, the ECB's digital euro aims to provide a secure and regulated alternative, ensuring that the euro remains relevant in the digital age.

— Curated by the World Pulse Now AI Editorial System