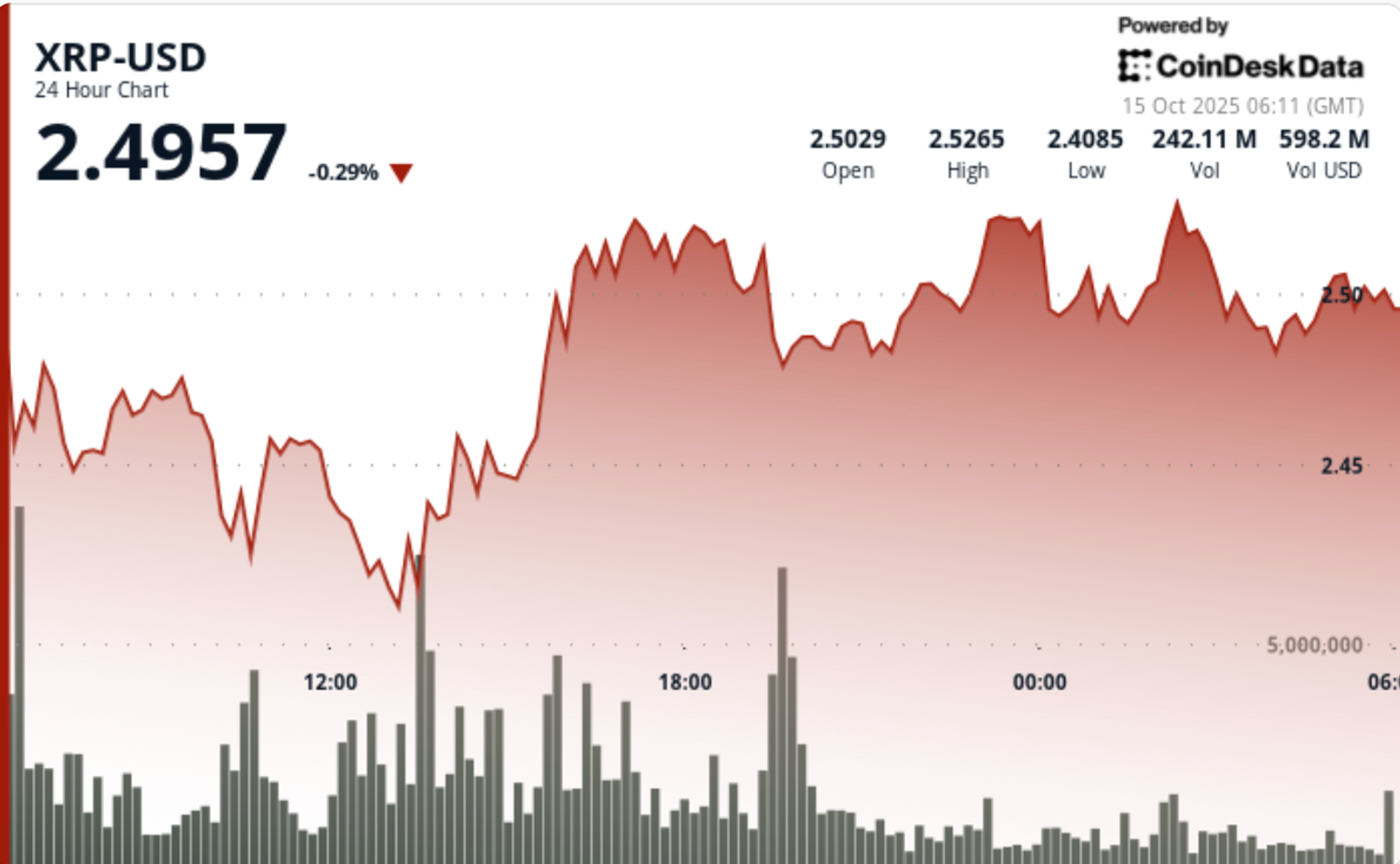

XRP Tests $2.40 Base After 6% Swing; Eyes $2.65 Breakout Level

PositiveCryptocurrency

XRP has shown resilience by testing a $2.40 base after a notable 6% swing, indicating strong market interest and potential for further gains. Investors are now closely watching for a breakout at the $2.65 level, which could signal a bullish trend and attract more traders to the cryptocurrency. This movement is significant as it reflects the overall health of the crypto market and could influence trading strategies moving forward.

— Curated by the World Pulse Now AI Editorial System