DOGE ETF Buzz Meets Bearish Reality as Dogecoin Prints Fresh Lower Lows

NegativeCryptocurrency

- Dogecoin has recently experienced a significant decline, with its price hitting fresh lower lows amidst a bearish market sentiment. This downturn follows the disappointing debut of Grayscale's first U.S. spot Dogecoin ETF, which launched on November 24, 2025, but failed to meet trading volume expectations, garnering only $1.41 million on its first day.

- The lackluster performance of the Dogecoin ETF raises concerns about investor interest and confidence in Dogecoin as a viable investment. The ETF's underwhelming start could hinder future growth and adoption of Dogecoin in the cryptocurrency market.

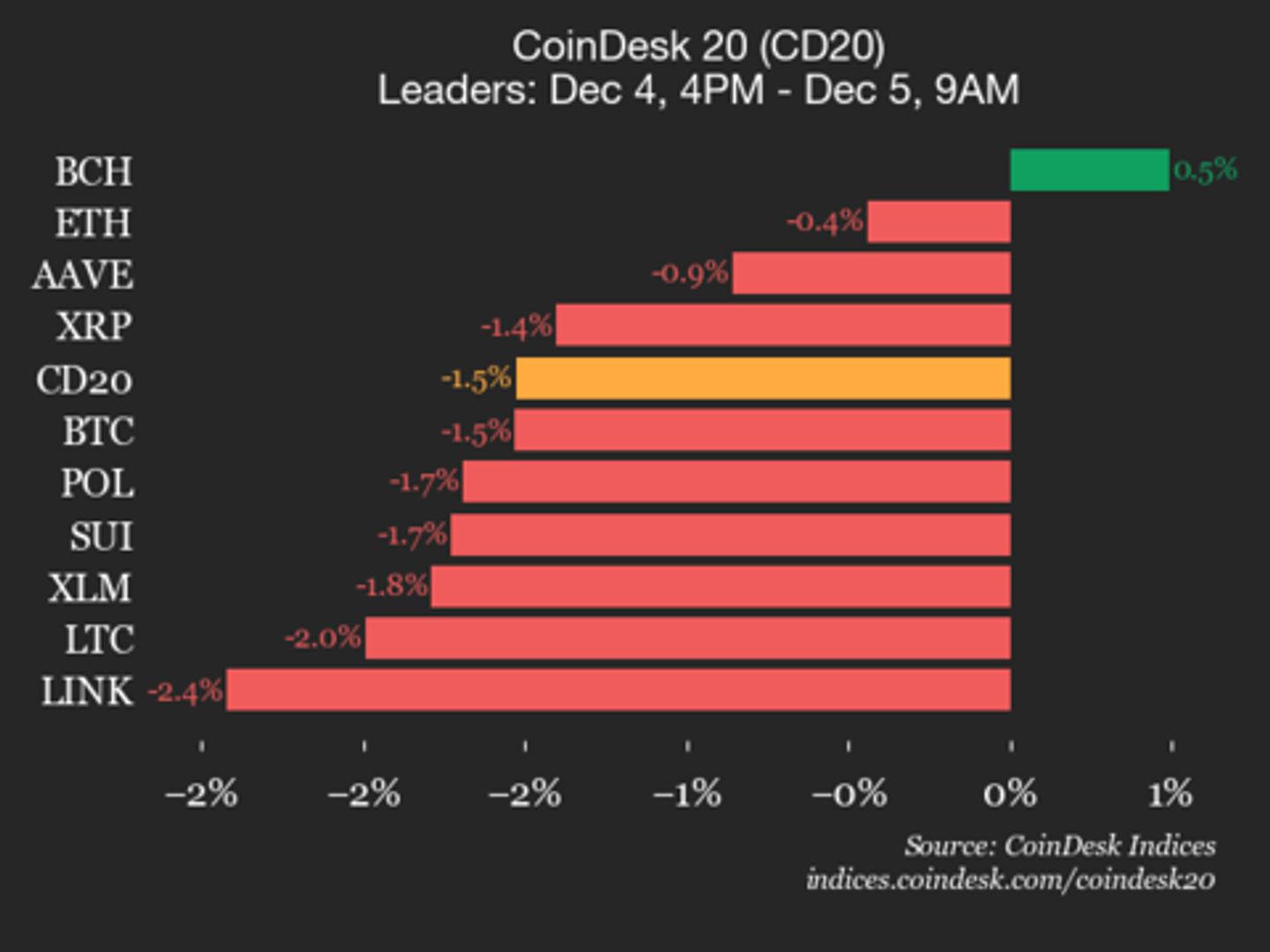

- This situation reflects broader challenges within the cryptocurrency sector, where investor sentiment remains cautious. The underperformance of Dogecoin contrasts with other cryptocurrencies like XRP and Solana, which have seen more favorable trading volumes and market responses, highlighting the volatility and unpredictability of the crypto landscape.

— via World Pulse Now AI Editorial System