CFTC withdraws outdated crypto delivery guidance amid broader digital asset reform

NeutralCryptocurrency

- The Commodity Futures Trading Commission (CFTC) has withdrawn its outdated crypto delivery guidance as part of a broader effort to reform regulations surrounding digital assets. This decision reflects the need for updated frameworks that align with the evolving cryptocurrency market and its complexities.

- By eliminating the outdated guidance, the CFTC aims to streamline regulatory processes, making it easier for market participants to navigate compliance requirements. This move is expected to foster innovation and enhance the overall efficiency of the digital asset market.

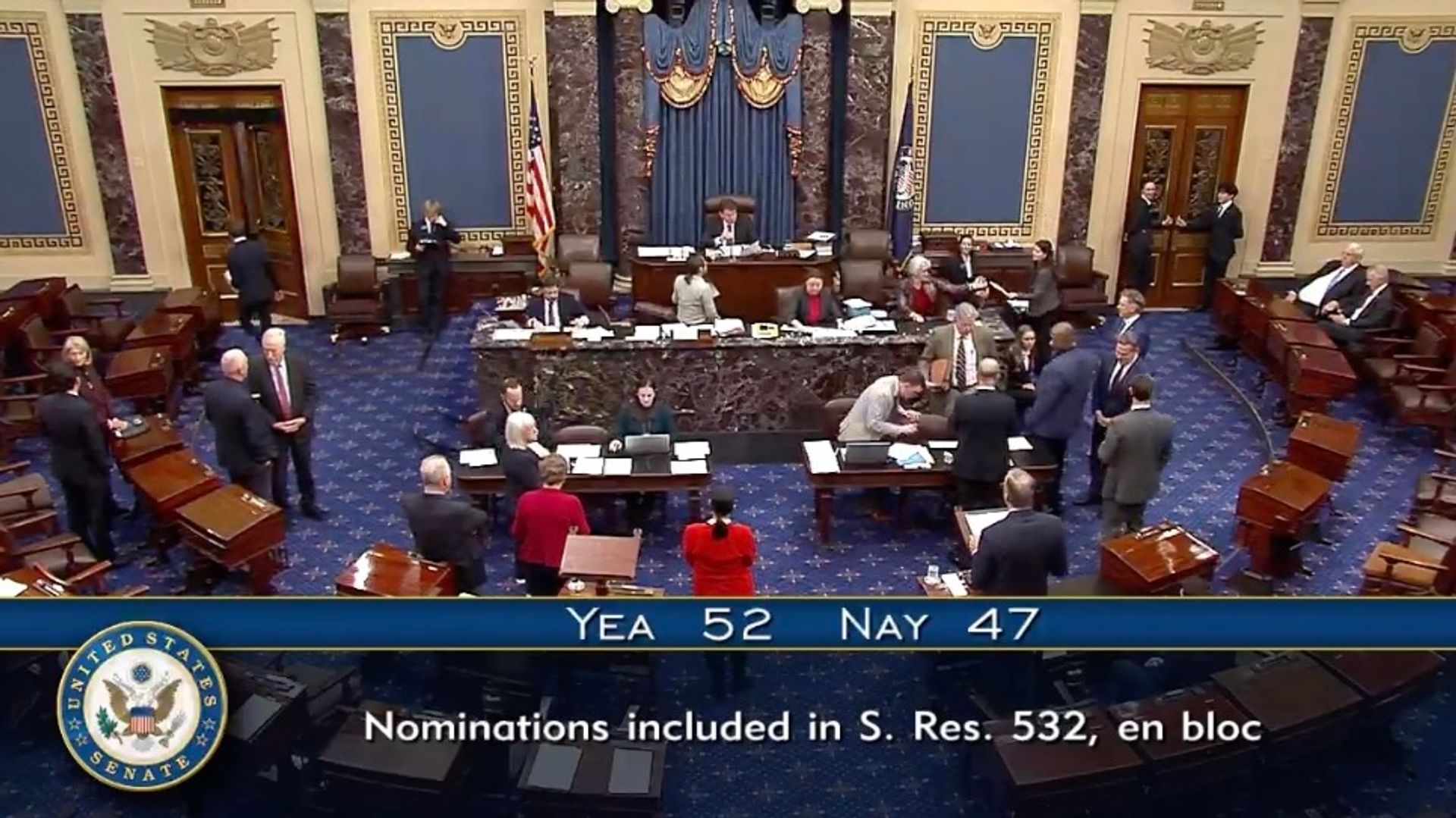

- The withdrawal of the guidance coincides with other significant regulatory developments, including proposed overhauls of anti-money laundering oversight and increased scrutiny on low-priced securities. These actions indicate a concerted effort by U.S. regulatory bodies to establish a more cohesive and effective regulatory environment for cryptocurrencies and related financial products.

— via World Pulse Now AI Editorial System