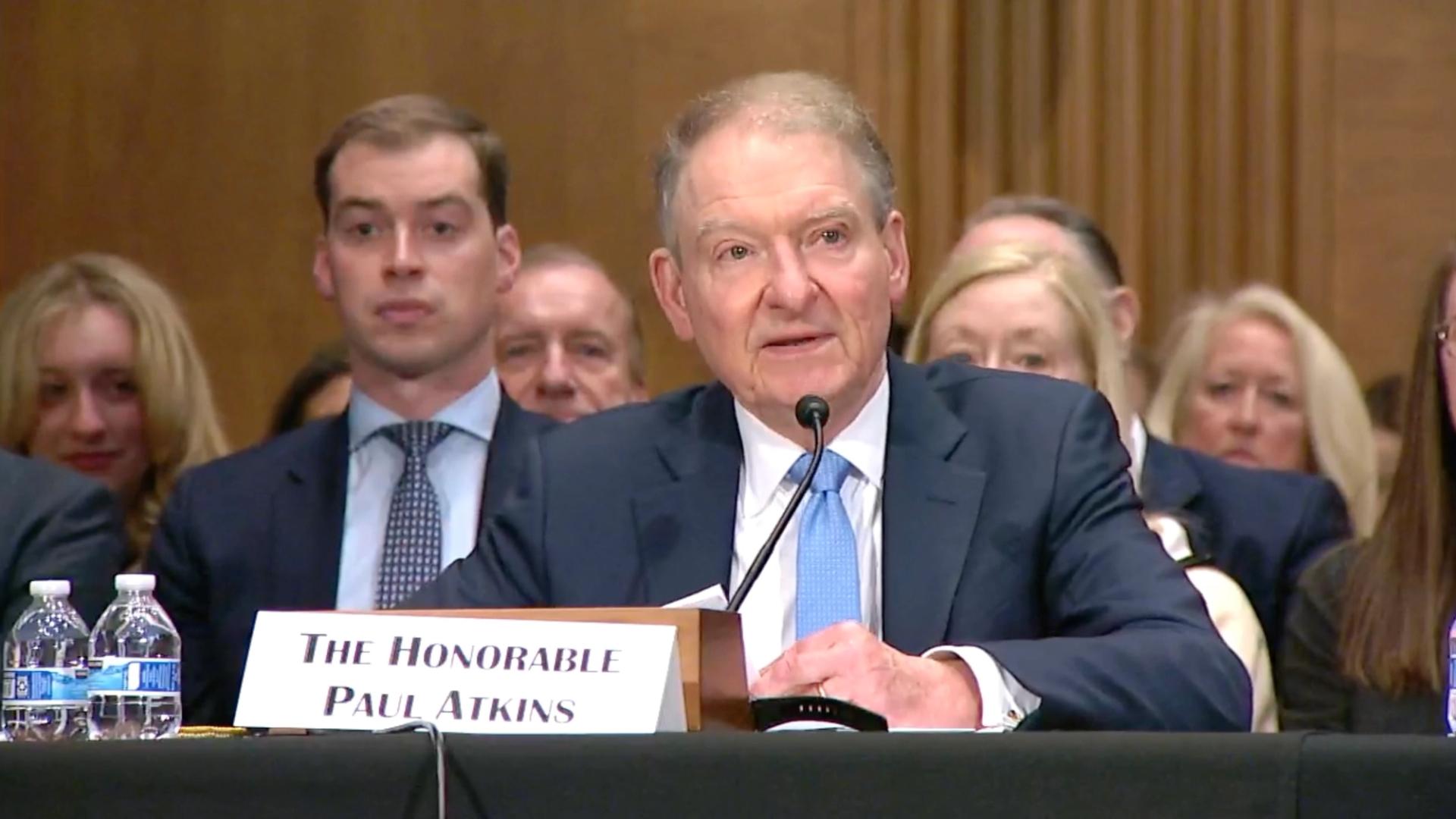

SEC plans to introduce innovation exemption for crypto firms by EOY

PositiveCryptocurrency

The SEC is planning to introduce an innovation exemption for crypto firms by the end of the year, which could significantly boost the U.S.'s competitiveness in the global crypto market. This move is seen as a positive step towards fostering technological growth and innovation in the industry, making it easier for companies to navigate regulatory challenges and thrive.

— Curated by the World Pulse Now AI Editorial System