Euro Stablecoin Set for 2026 Launch as 9 Banks Unite – Best Wallet Token ($BEST) Emerges a Presale Winner

PositiveCryptocurrency

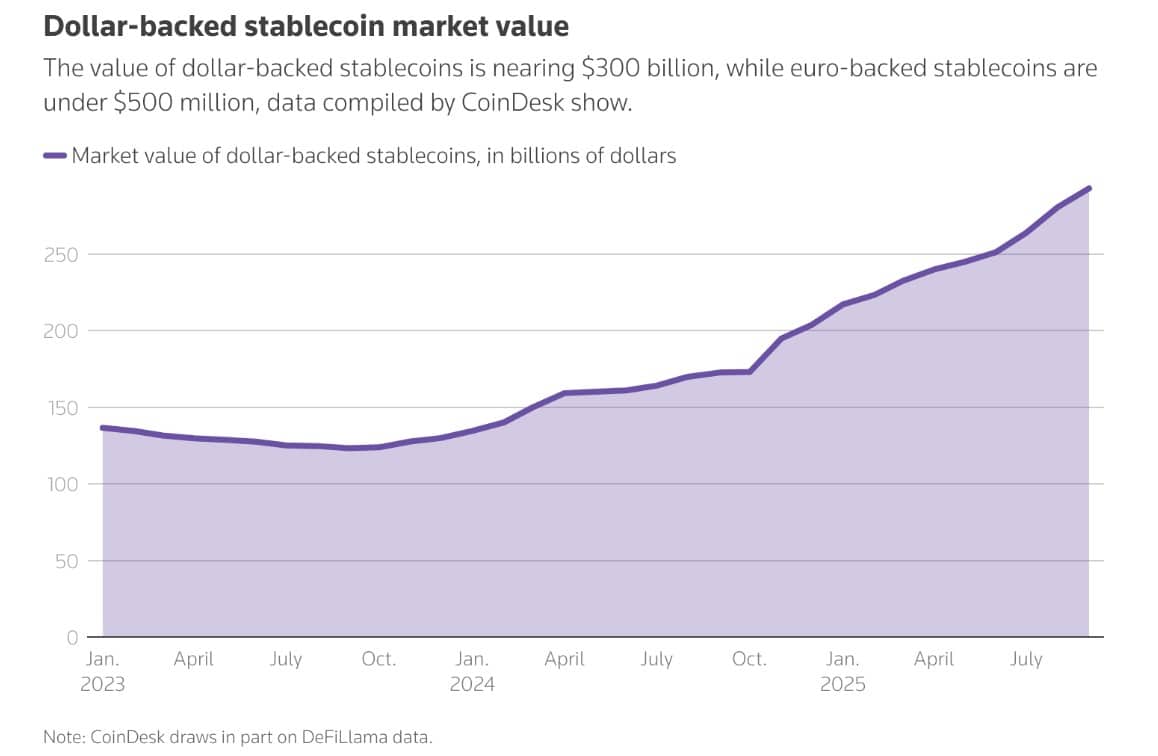

A consortium of nine European banks has come together to develop a euro-backed stablecoin, with plans to launch it in the latter half of 2026. This initiative is significant as it aims to enhance the digital currency landscape in Europe, providing a stable alternative for transactions and investments. The collaboration includes major banks from various countries, indicating a strong commitment to innovation in the financial sector.

— Curated by the World Pulse Now AI Editorial System