AVAX price prediction: Is AVAX headed for $50 next?

PositiveCryptocurrency

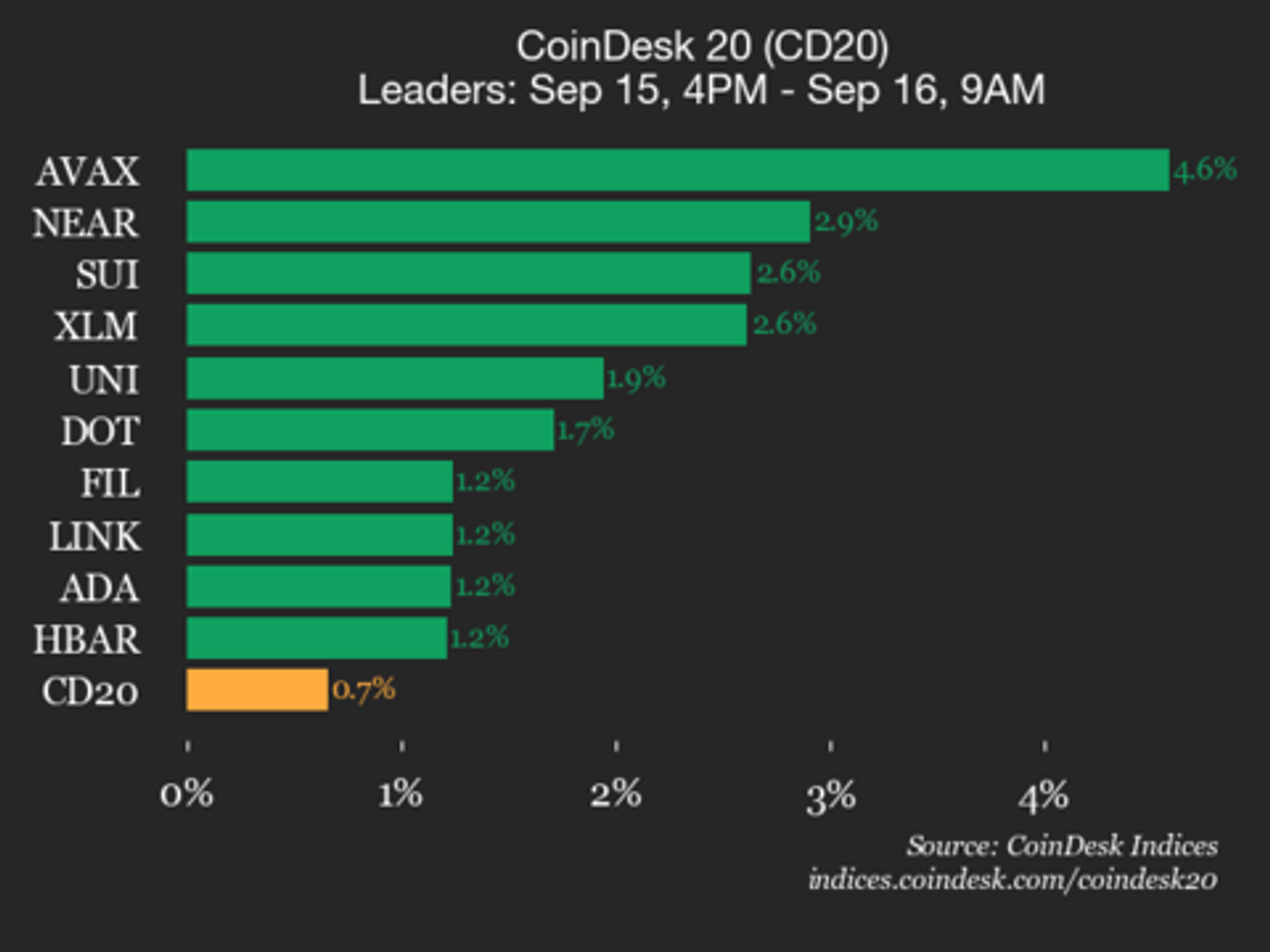

Avalanche's AVAX token is currently priced at around $29.8, following a recent rally that saw it attempt to break the crucial $30 barrier. Analysts are optimistic about its potential to reach $50, making this a significant moment for investors and traders alike. The interest in AVAX highlights the growing confidence in the cryptocurrency market, and its performance could influence broader trends in digital assets.

— Curated by the World Pulse Now AI Editorial System