Binance Adds $2B in Stablecoins In One Day As FOMC Speculation Heats Up

PositiveCryptocurrency

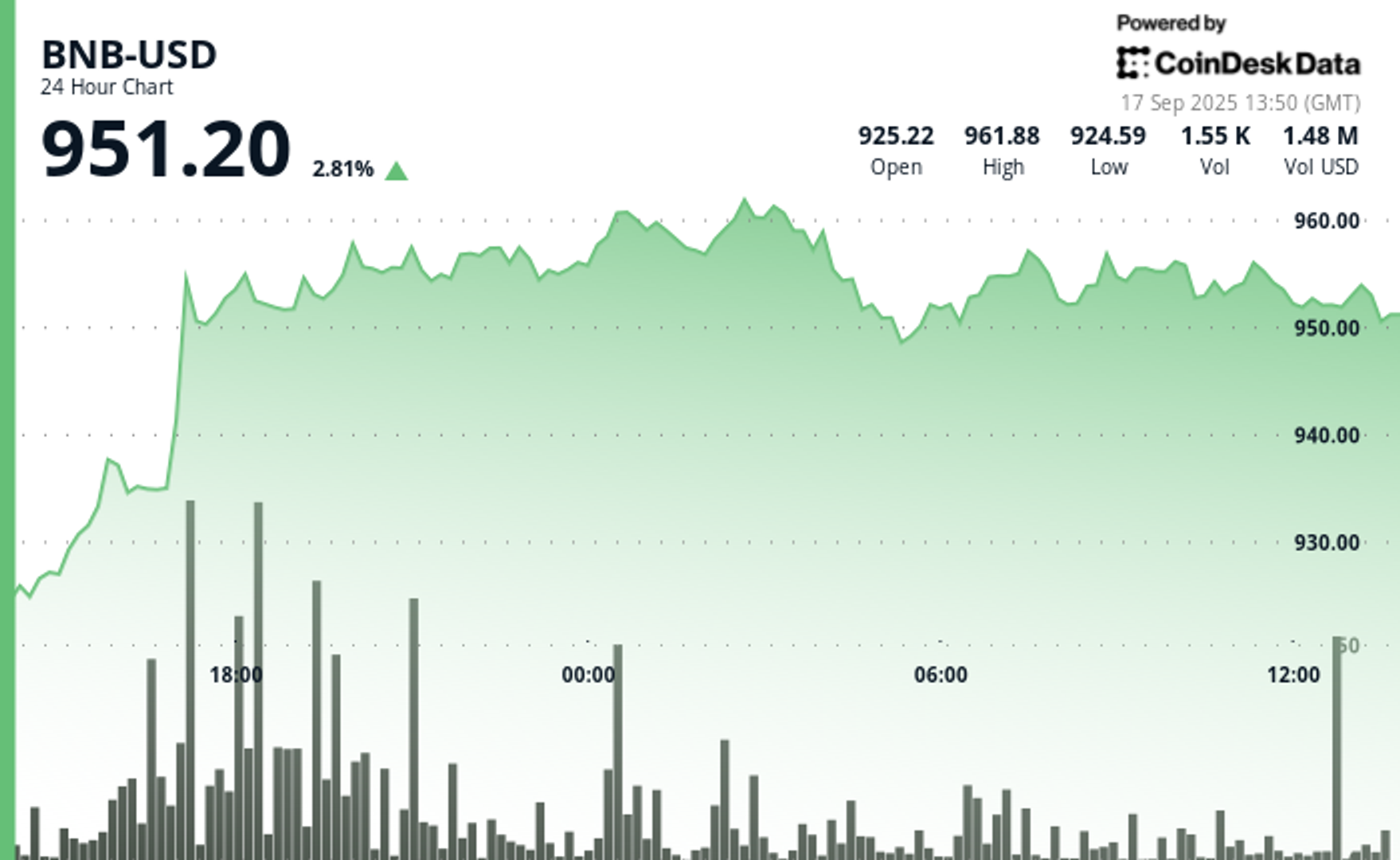

Binance is making headlines again, having added $2 billion in stablecoins in just one day, which has contributed to its native token reaching an impressive $963. This surge is a clear indicator of market optimism and Binance's growing influence in the cryptocurrency space. Analyst Darkfost points out that the rapid growth of ERC-20 stablecoins is a significant factor driving this rally. This development is important as it showcases the increasing confidence in the crypto market and Binance's pivotal role in shaping its future.

— Curated by the World Pulse Now AI Editorial System