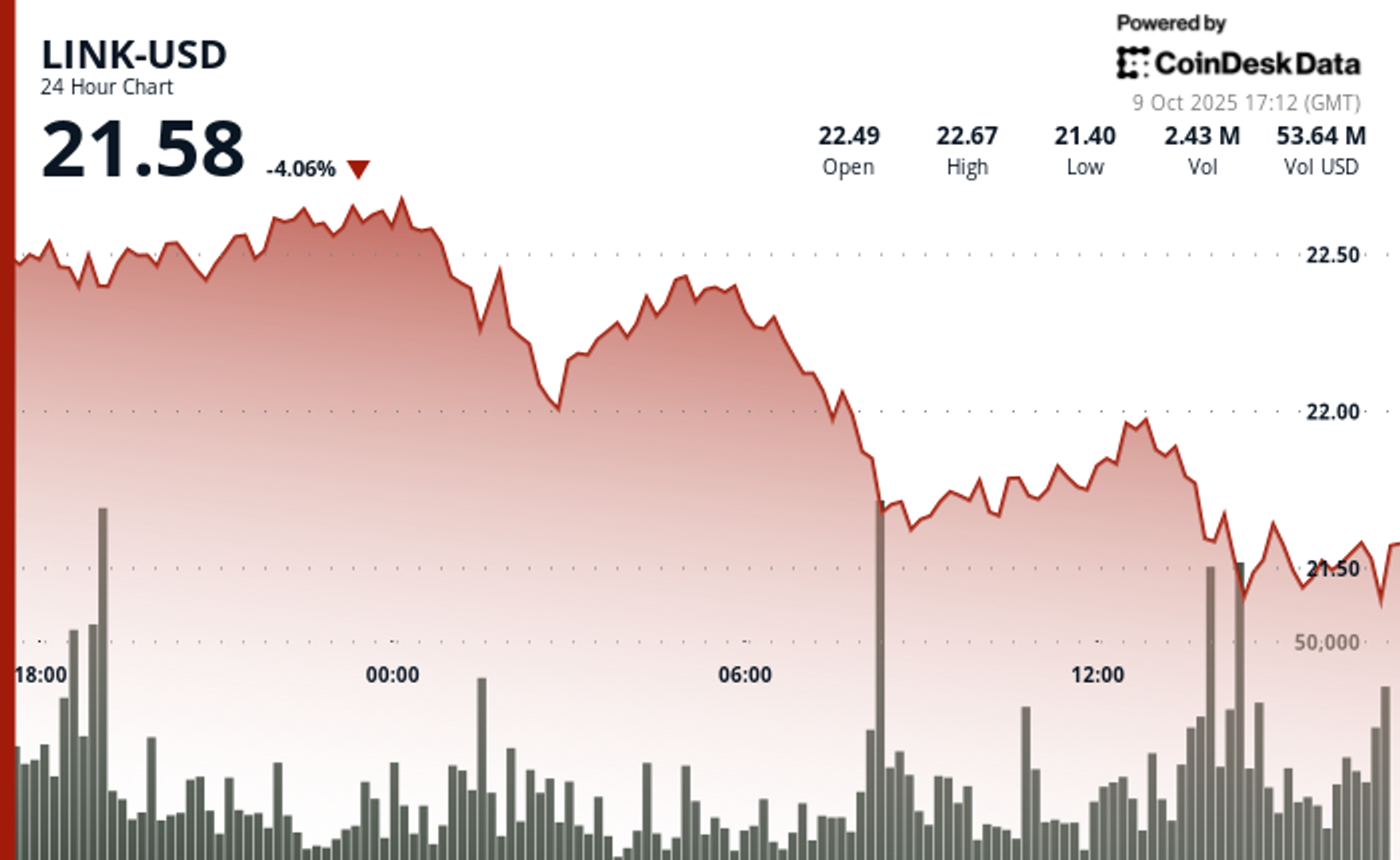

Chainlink's LINK Tumbles 4% as Selling Pressure Mounts

NegativeCryptocurrency

Chainlink's LINK token has seen a significant drop of 4% amid increasing selling pressure, highlighting the heightened volatility in the cryptocurrency market. This decline comes as trading volumes surged during a crucial technical breakdown, raising concerns among investors. Understanding these market movements is essential for anyone involved in cryptocurrency, as they can indicate broader trends and potential risks.

— Curated by the World Pulse Now AI Editorial System