Ethereum tops 24-hour net inflows with $138.7M: Artemis

PositiveCryptocurrency

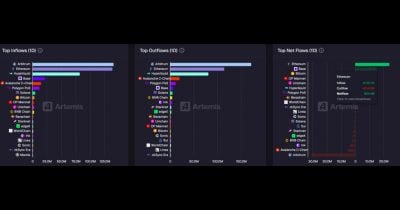

- Ethereum has achieved significant net inflows of $138.7 million within a 24-hour period, underscoring its growing influence in the cryptocurrency market. This influx signals a positive shift in investor sentiment towards Ethereum, reflecting its potential to lead advancements in digital finance and blockchain technology.

- The substantial inflows into Ethereum highlight its increasing dominance among cryptocurrencies, suggesting a robust demand that could drive further innovation and adoption in the blockchain space. This trend may also bolster investor confidence in Ethereum's long-term viability and growth prospects.

- The recent developments in Ethereum's market dynamics, including a bullish reversal pattern and increased trading volumes, indicate a broader recovery in the cryptocurrency sector. As Ethereum continues to reclaim key price levels and attract significant investments, it reflects a potential shift in market sentiment that may influence the overall landscape of digital assets.

— via World Pulse Now AI Editorial System