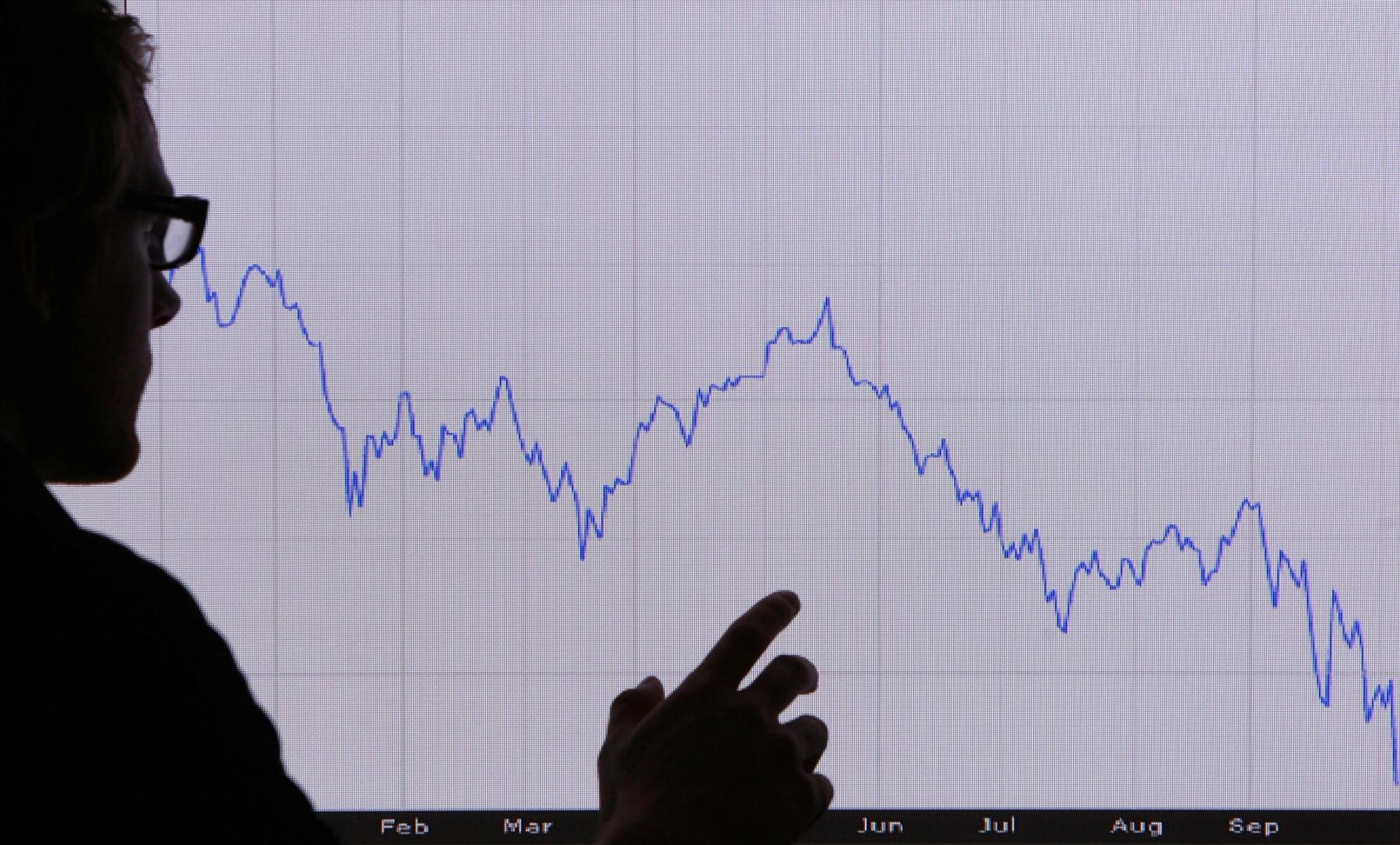

Argentina and US Treasury Ink $20 Billion Swap Line as Trump Warns the Latam Country Is ‘Dying’

NeutralCryptocurrency

Argentina has secured a $20 billion swap line with the US Treasury, a significant financial move amidst warnings from former President Trump about the country's economic struggles. This agreement is crucial as it aims to stabilize Argentina's economy and provide much-needed liquidity, especially in the face of ongoing challenges. The swap line could help bolster investor confidence and support Argentina's efforts to navigate its financial difficulties.

— Curated by the World Pulse Now AI Editorial System

![[LIVE] Crypto News Today, October 22 – Bitcoin Is Retesting $107K As Trump Plays Tariffs Card; XRP Can’t Break The $2.5 Wall – Time To Find The Next Crypto To Explode?](https://dummyimage.com/600x400/1a4a3b/ffffff.png&text=World Pulse Now)