FOMC Minutes Signal More Possible Rate Cuts as Bitcoin Continues to Climb

PositiveCryptocurrency

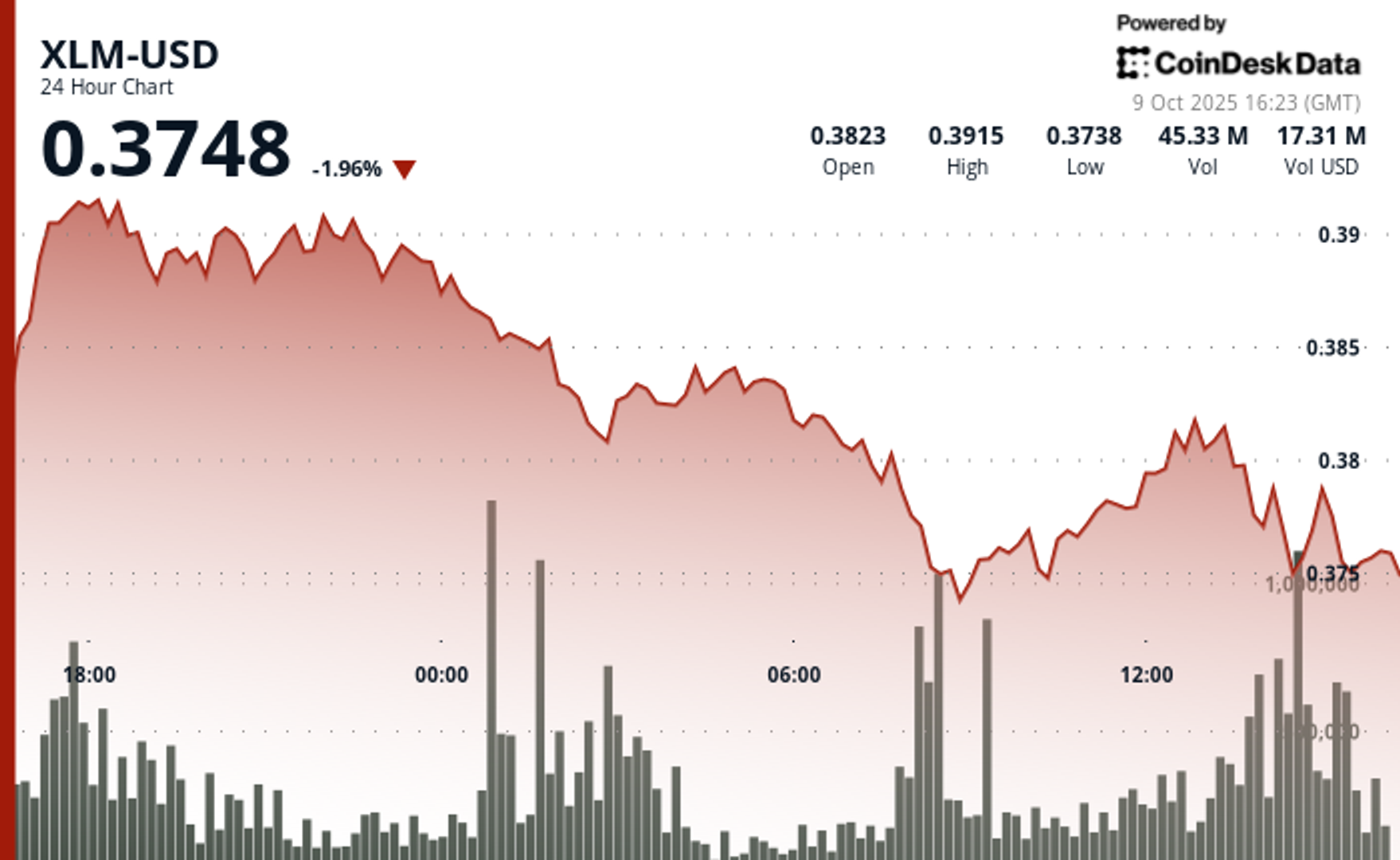

The latest FOMC minutes reveal a strong inclination towards further rate cuts, which could significantly impact the economy and financial markets. This is particularly important as the Fed aims to balance inflation control with employment growth. As Bitcoin continues to rise, this environment may present a prime opportunity for investors looking to capitalize on the crypto market's momentum. Understanding these developments is crucial for anyone interested in finance and investment.

— Curated by the World Pulse Now AI Editorial System