Bitcoin Drops After ATH; BNB Cements No. 3 Spot

NegativeCryptocurrency

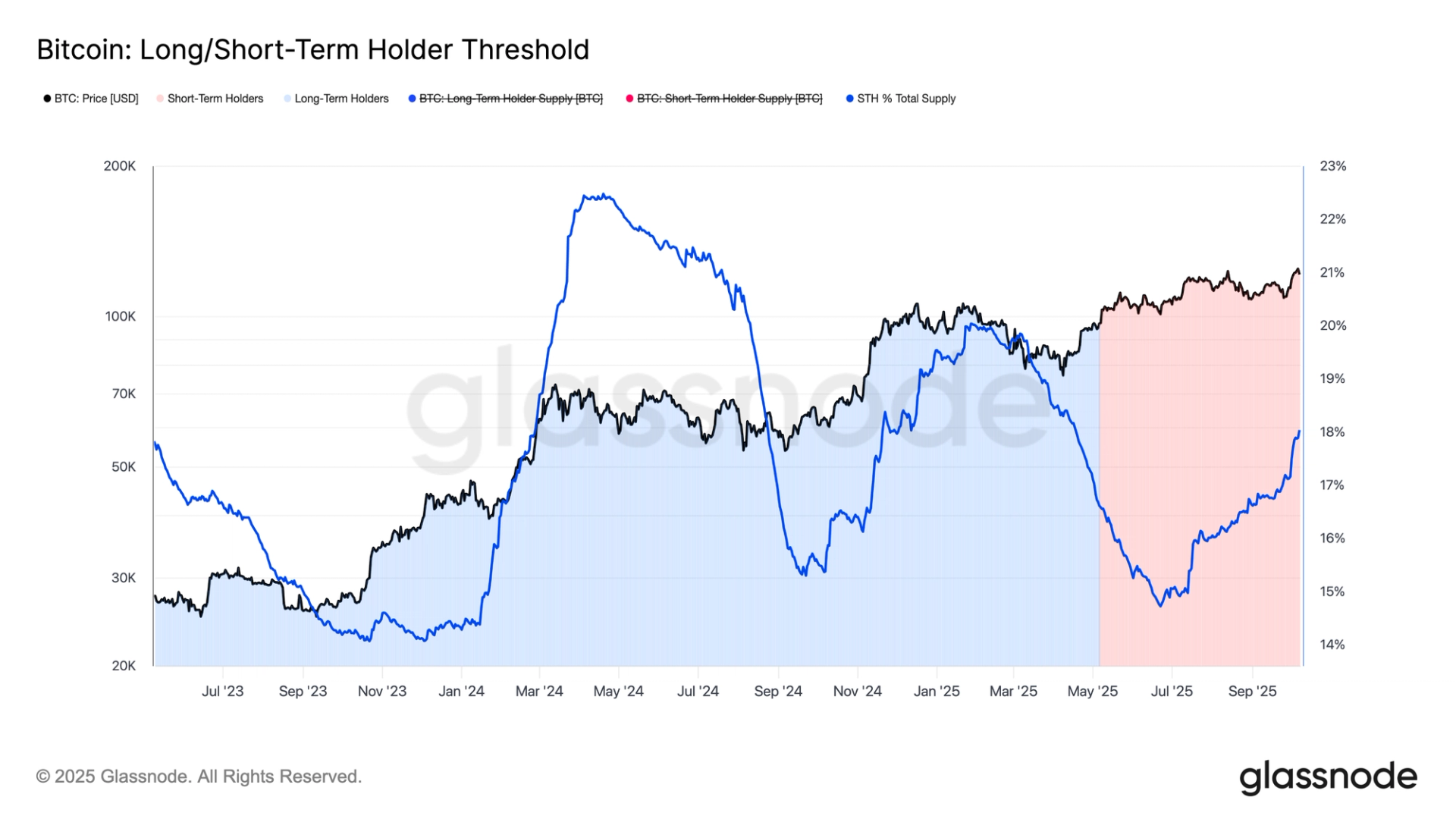

Bitcoin has experienced a significant drop after reaching an all-time high, which has raised concerns among investors about the stability of the cryptocurrency market. Meanwhile, BNB has solidified its position as the third-largest cryptocurrency, showcasing its resilience amidst the fluctuations. This situation is crucial as it highlights the volatility of digital currencies and the need for investors to stay informed and cautious.

— Curated by the World Pulse Now AI Editorial System