Ethereum Market Outlook: $4,100 Resistance Holds as BlackRock and Major Funds Boost Exposure

PositiveCryptocurrency

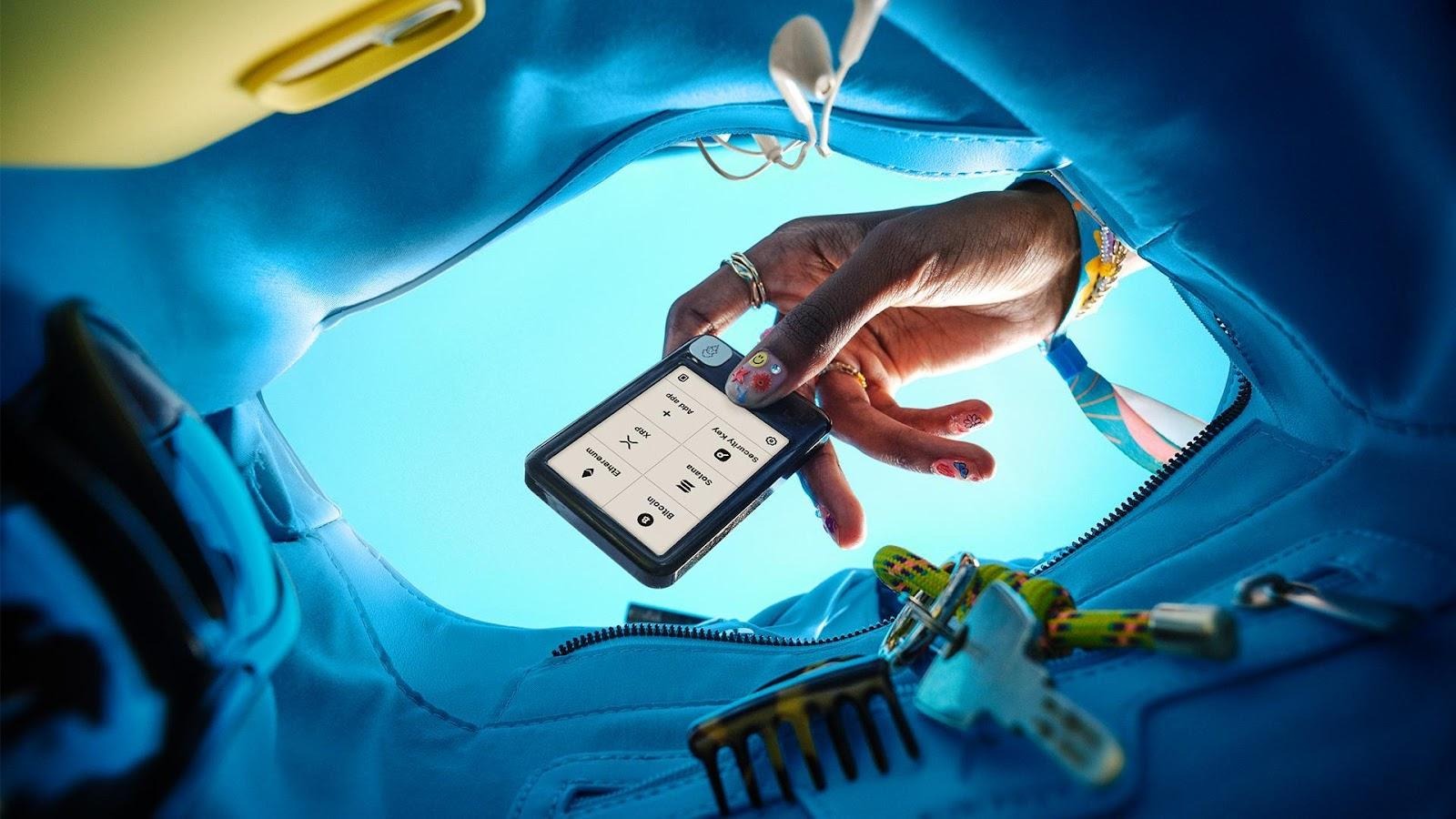

Ethereum is regaining traction in the market as major funds, including BlackRock, increase their investments in the smart-contract platform. After a challenging period, the recent purchase of approximately $251 million worth of ETH by Bitmine Immersion Technologies highlights a renewed institutional interest. This shift is significant as it could signal a recovery for Ethereum and potentially influence broader market trends, making it an exciting time for investors.

— Curated by the World Pulse Now AI Editorial System