Bitcoin Bollinger Bands repeat ‘parabolic’ bull signal from late 2023

PositiveCryptocurrency

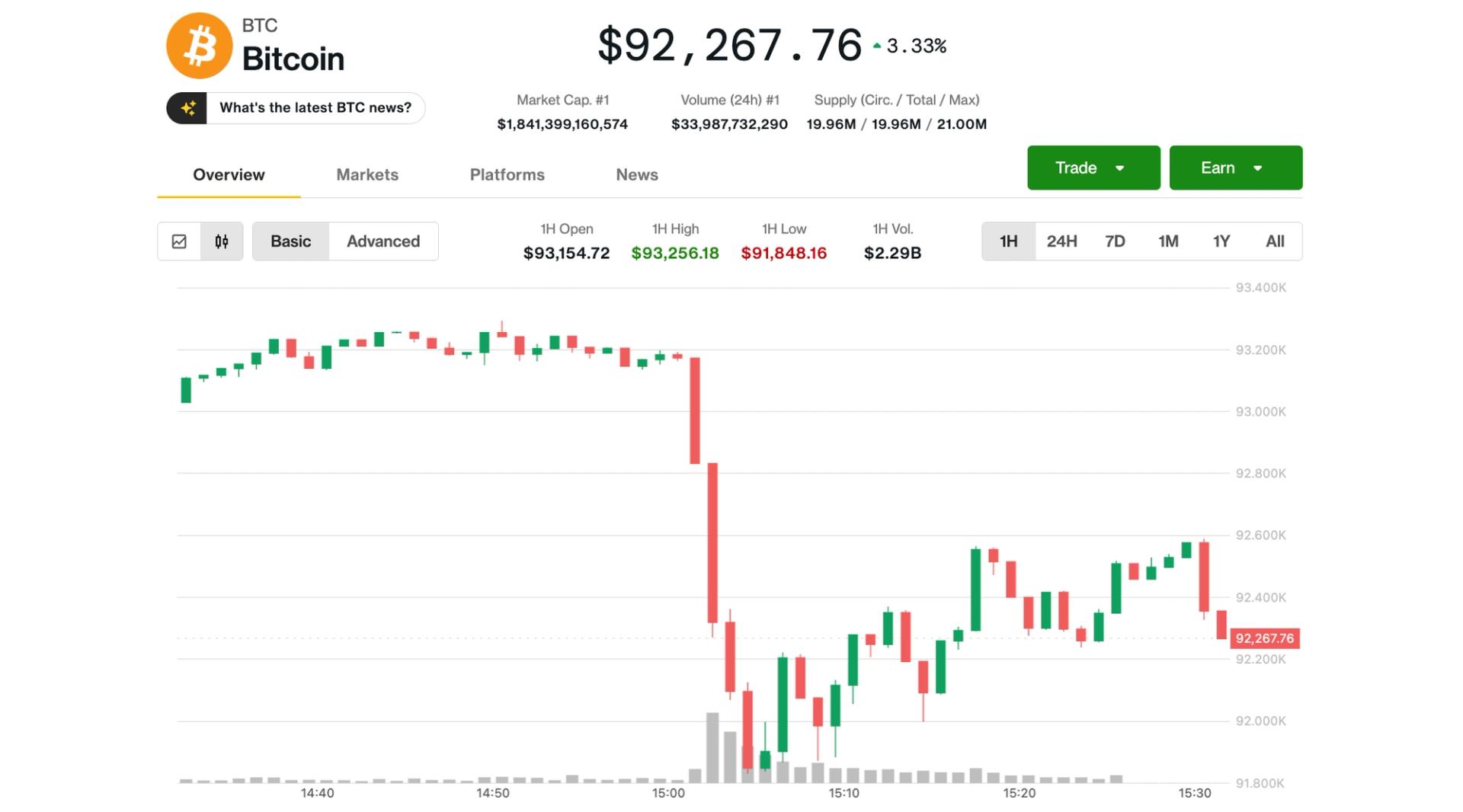

- Bitcoin's Bollinger BandWidth has reached record lows, signaling a potential bullish trend as it printed a classic 'green' signal in November, which historically led to a 40% price increase for BTC.

- This development is significant as it suggests a renewed optimism among investors, potentially indicating a recovery phase for Bitcoin after recent market fluctuations.

- The current bullish sentiment is further supported by indicators showing a shift from extreme fear to optimism, alongside projections of a 96% chance of price recovery by 2026, reflecting a broader recovery trend in the cryptocurrency market.

— via World Pulse Now AI Editorial System