Bitcoin Trades in Tight Range as Analysts Debate Whether the Four-Year Cycle Is Officially Over

NeutralCryptocurrency

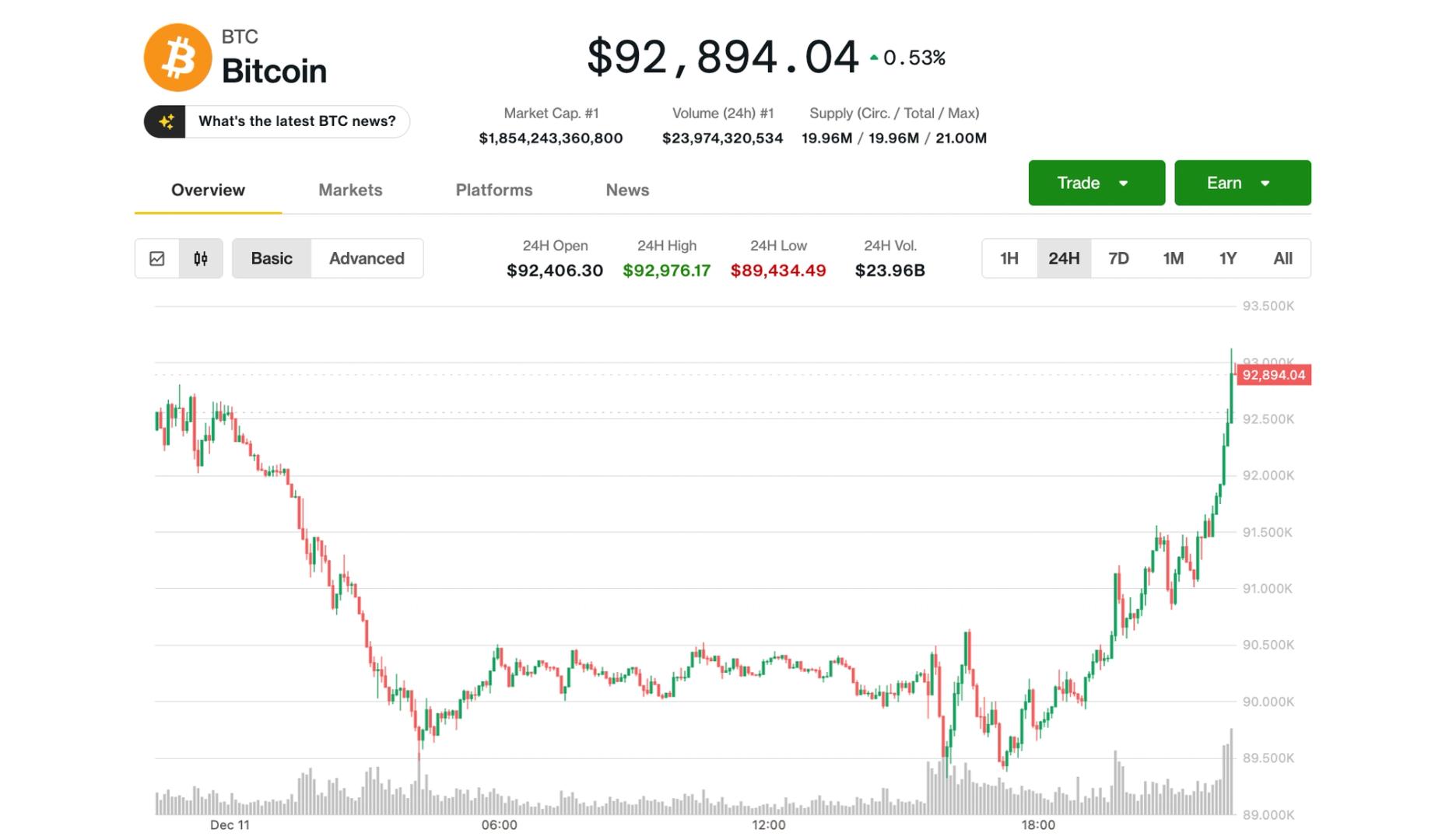

- Bitcoin is currently trading within a narrow price range, with analysts questioning whether the traditional four-year cycle that has historically influenced its price is still relevant. Despite macroeconomic shifts and mixed signals from the Federal Reserve, Bitcoin's price movements remain constrained, reflecting a cautious market environment.

- This situation is significant as it highlights the evolving dynamics of Bitcoin's market, where institutional flows and macroeconomic factors may be taking precedence over historical price patterns. The debate over the four-year cycle's relevance could impact trading strategies and investor sentiment.

- The current price stability above key support levels, alongside the recent Federal Reserve rate cuts, underscores a complex interplay of market forces. While some analysts suggest a departure from the four-year cycle, others remain skeptical, indicating a broader uncertainty in the cryptocurrency market as traders navigate potential volatility and changing economic conditions.

— via World Pulse Now AI Editorial System