Four XRP price charts that are predicting a rally toward $3

PositiveCryptocurrency

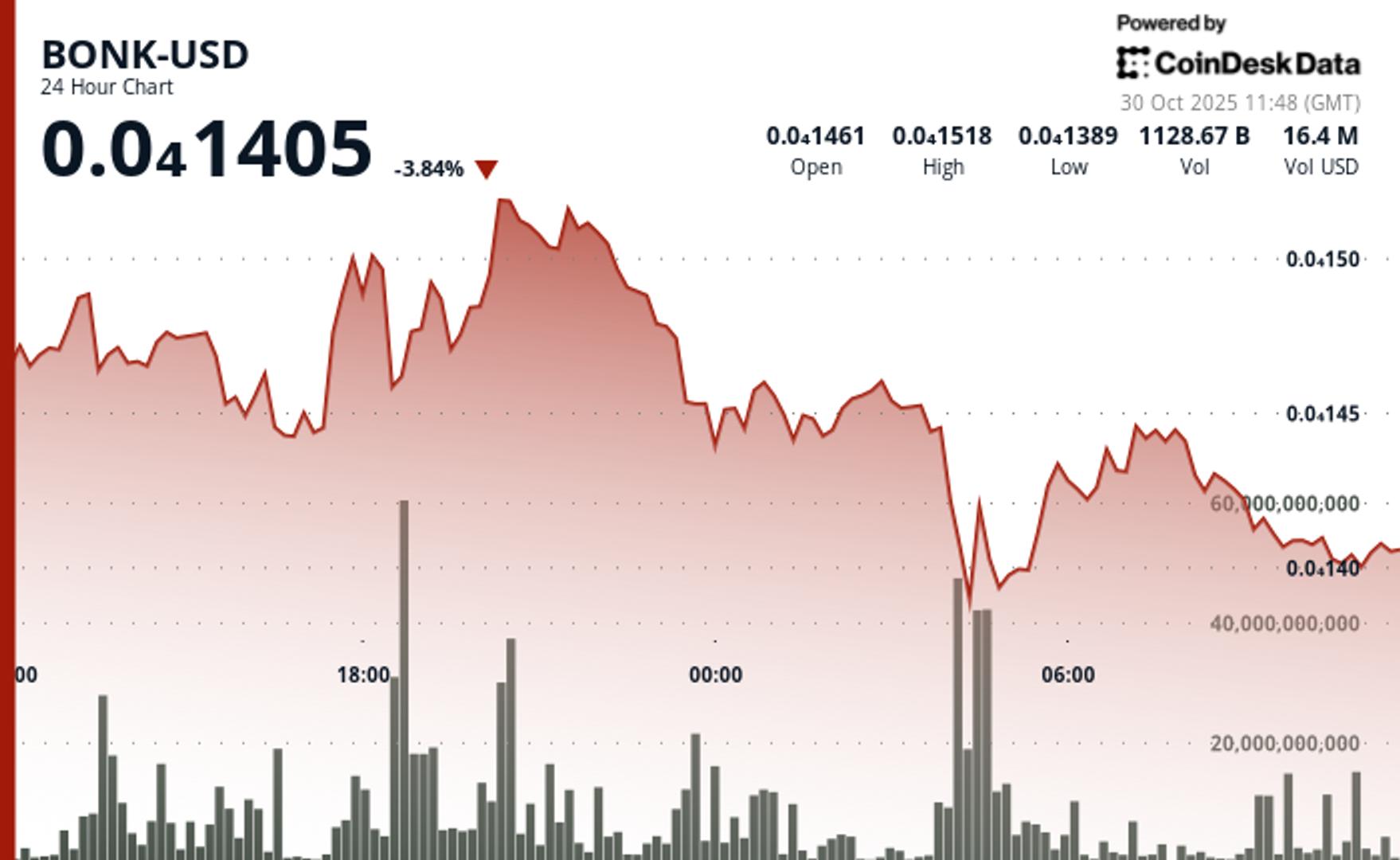

Recent technical indicators are showing promising signs for XRP, suggesting a potential price rally towards $3 in the near future. This is particularly significant as the balance on exchanges has reached a five-year low, indicating a possible supply squeeze that could drive prices higher. Investors and traders are closely monitoring these developments, as a rally could have a substantial impact on the cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System