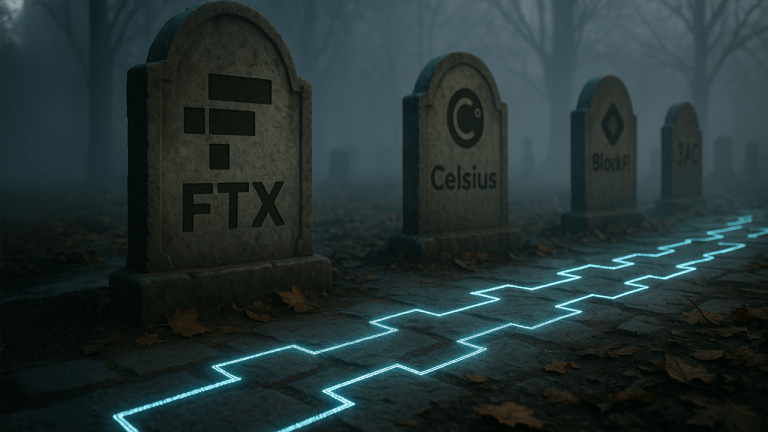

Crypto markets show volatility with Ripple's bullish SEC deal sparking XRP rally hopes, while Trump's $57M gain and SharpLink's $463M ETH bet highlight big moves. Meanwhile, $1.5B remains trapped in failed firms like FTX, underscoring risks. Sentiment: neutral

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Live Stats

8,525

127

211

4 hours ago

Mobile App

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Live Stats

8,525

127

211

4 hours ago

Mobile App

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more