Innovate & Invest, Or You Will Be Out of AI Race: Drury

PositiveFinancial Markets

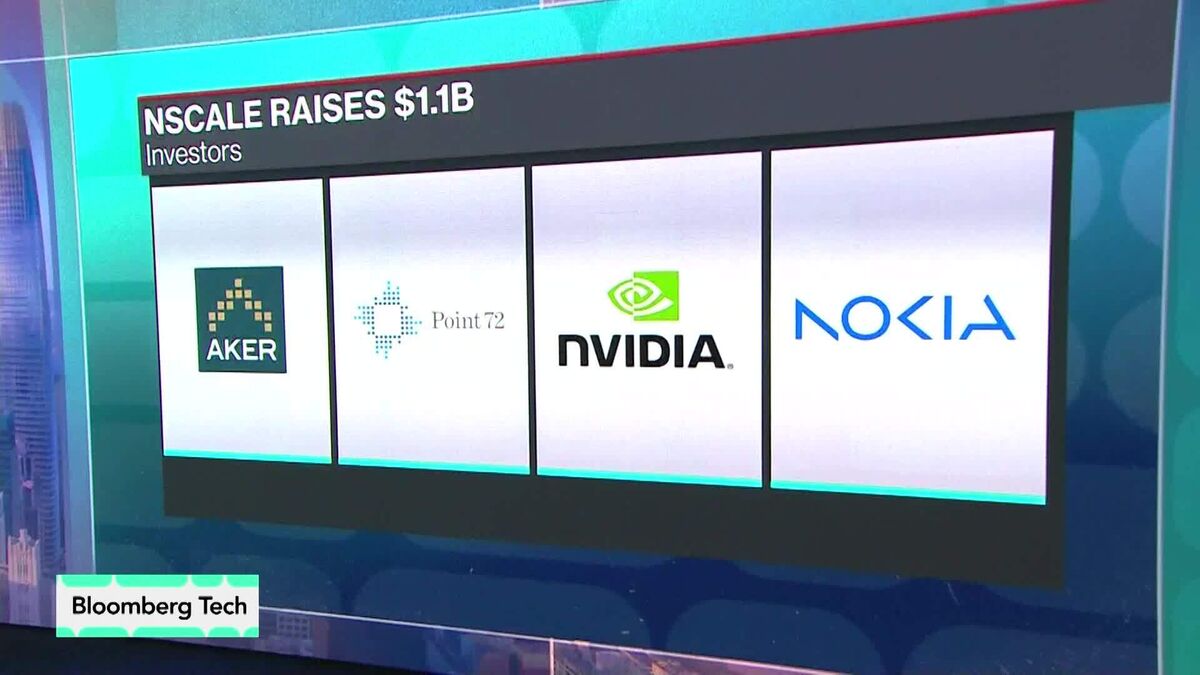

Philip Drury, a prominent CIO and former head of technology at Citigroup, emphasizes the importance of investing in AI to stay competitive. He highlights recent investments in Intel by major players like Nvidia and SoftBank, suggesting a significant collaboration in technology. Drury believes the current AI boom is more transformative than the dot-com era, likening its impact to that of railroads and steel. This perspective underscores the urgency for companies to innovate and invest in AI to avoid falling behind.

— Curated by the World Pulse Now AI Editorial System