Truist: uniQure’s FDA setback has minimal impact on PTC and Wave

NeutralFinancial Markets

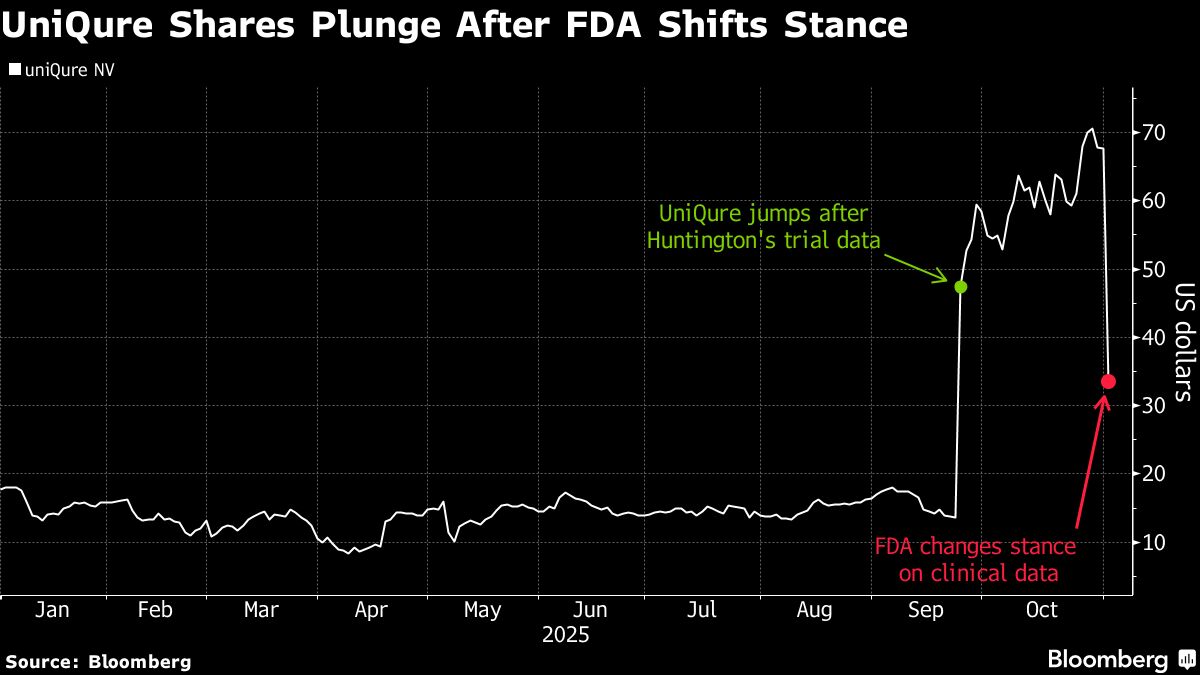

Truist has assessed that uniQure's recent setback with the FDA will have minimal impact on PTC and Wave. This is significant as it highlights the resilience of these companies in the face of regulatory challenges, suggesting that their operations and future prospects remain stable despite the hurdles faced by uniQure.

— Curated by the World Pulse Now AI Editorial System