Vast's Lead Astronaut on the Next Era of Space

PositiveFinancial Markets

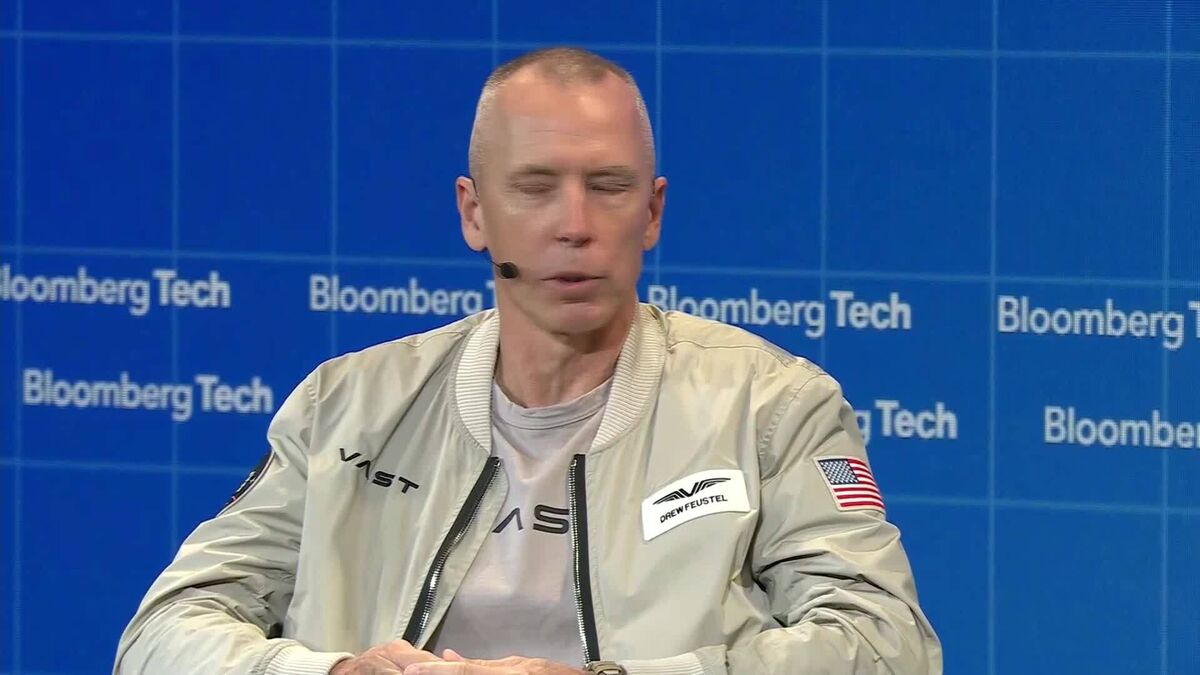

Andrew Feustel, the Lead Astronaut at Vast, recently shared insights on the exciting future of commercial space travel during an interview with Bloomberg’s Jillian Deutsch in London. He emphasized the importance of orbital infrastructure and global collaboration in advancing space exploration. This discussion is significant as it highlights the growing role of private companies in space and the potential for international partnerships to enhance our capabilities beyond Earth.

— Curated by the World Pulse Now AI Editorial System