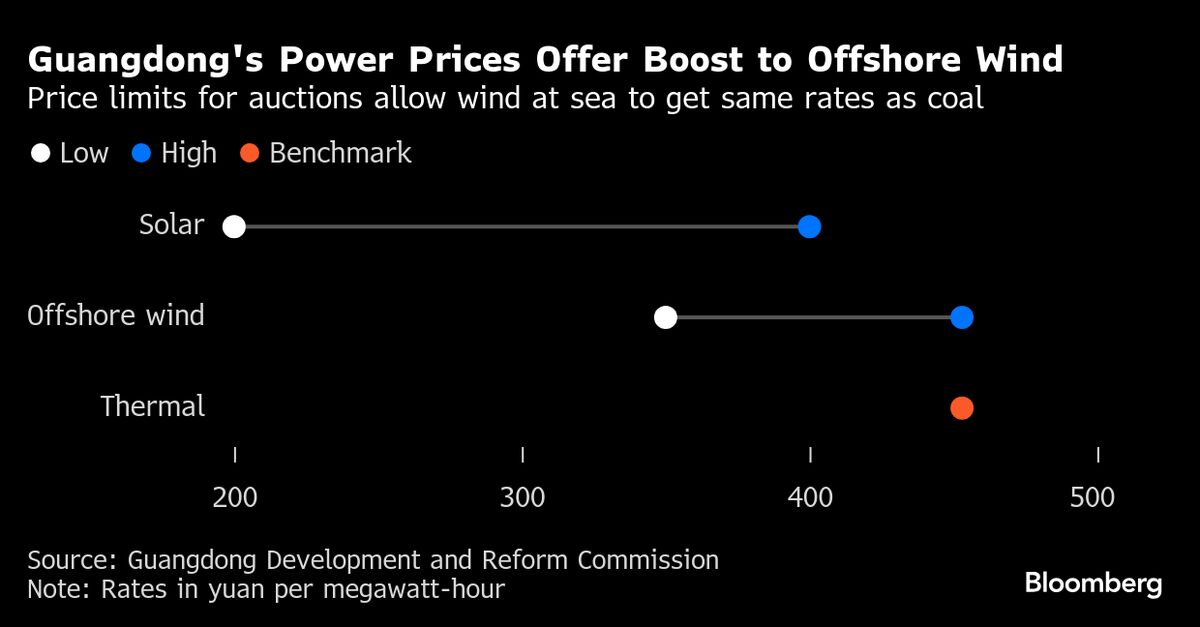

China’s New Market Tool Steers Clean Energy to Where It’s Needed

PositiveFinancial Markets

China is making strides in clean energy investment with its new market-based electricity pricing system. This innovative approach allows the country to direct resources to areas where clean energy is most needed, showcasing the potential for sustainable growth. By aligning energy production with demand, China is not only enhancing its energy efficiency but also setting a precedent for other nations to follow in the transition to greener energy solutions.

— Curated by the World Pulse Now AI Editorial System