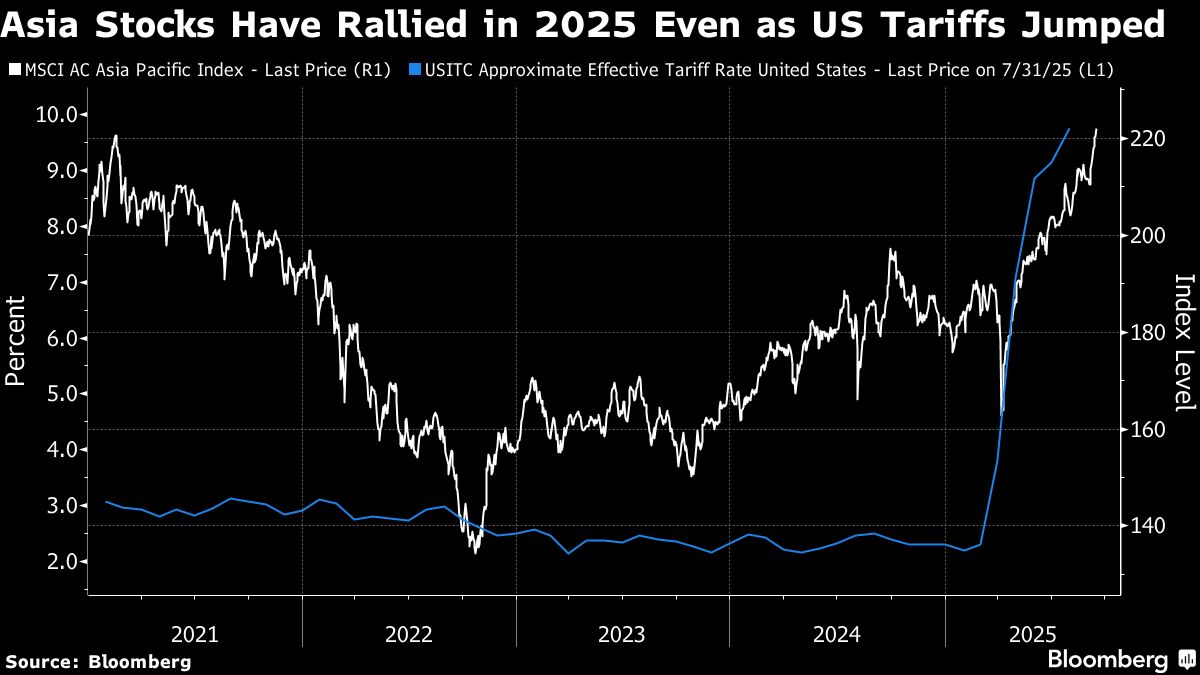

Asia’s Record Stock Rally May Unravel as Tariffs Bite, Funds Say

NegativeFinancial Markets

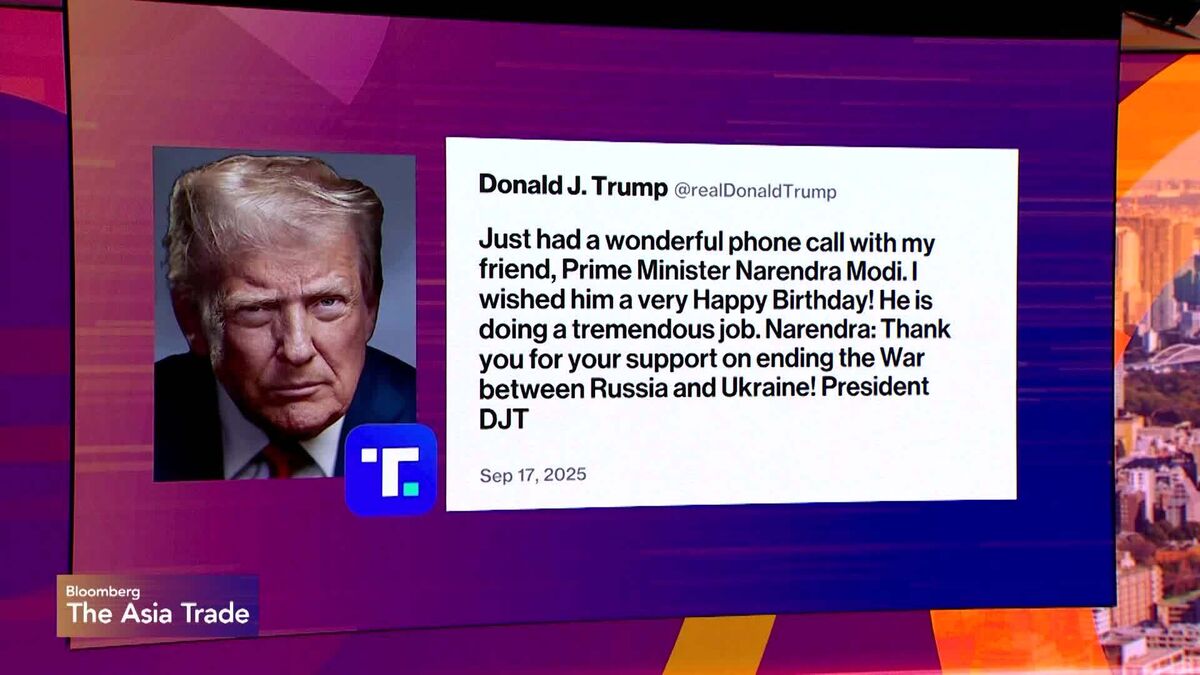

Asia's stock market has been on a record-breaking rally, but experts warn that this momentum may soon falter due to the impact of tariff hikes imposed by Donald Trump. These tariffs are expected to squeeze earnings, leading to concerns among major investment funds in the region. This situation is significant as it could signal a shift in market dynamics, affecting investors and the broader economy.

— Curated by the World Pulse Now AI Editorial System