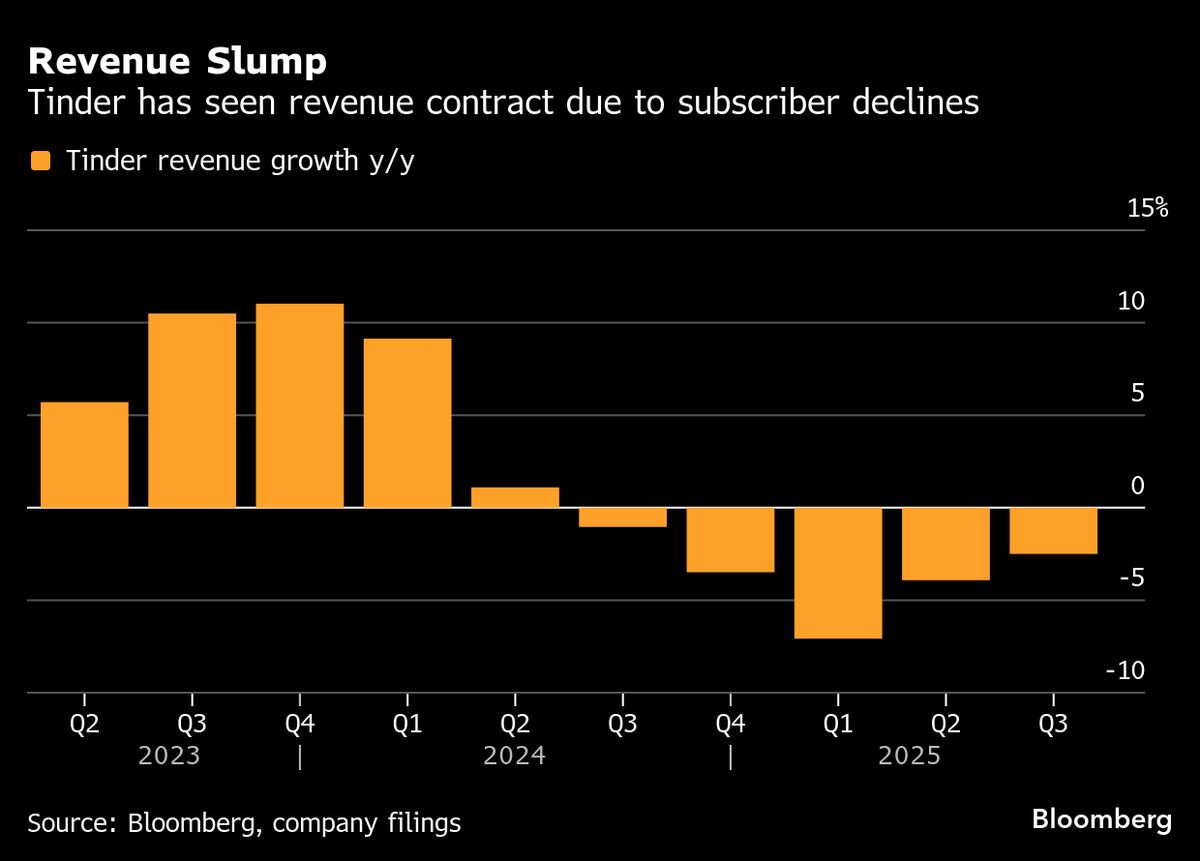

Match Group forecasts quarterly revenue below estimates as payers continue to slide

NegativeFinancial Markets

Match Group has announced that its quarterly revenue is expected to fall below estimates, primarily due to a continued decline in paying users. This news is significant as it highlights ongoing challenges for the company in retaining subscribers, which could impact its overall financial health and market position.

— Curated by the World Pulse Now AI Editorial System