China’s exports fall for first time since ‘liberation day’ trade tariffs

NegativeFinancial Markets

China’s exports fall for first time since ‘liberation day’ trade tariffs

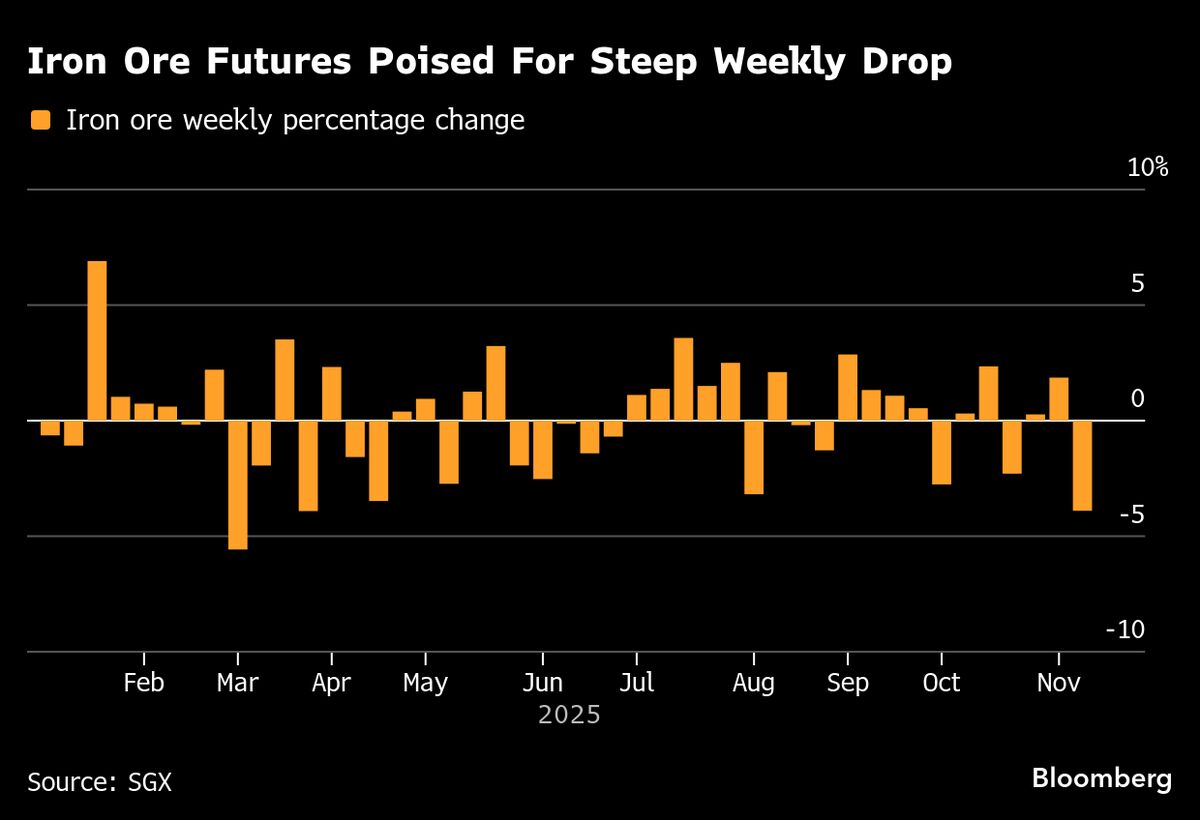

China's exports have experienced their first decline since the imposition of trade tariffs, marking a significant shift in the economic landscape. This unexpected downturn comes despite a recent truce between President Donald Trump and Chinese leader Xi Jinping, raising concerns about the ongoing trade tensions and their impact on global markets. The decline in exports could signal deeper economic challenges for China, making it a crucial development to watch.

— via World Pulse Now AI Editorial System