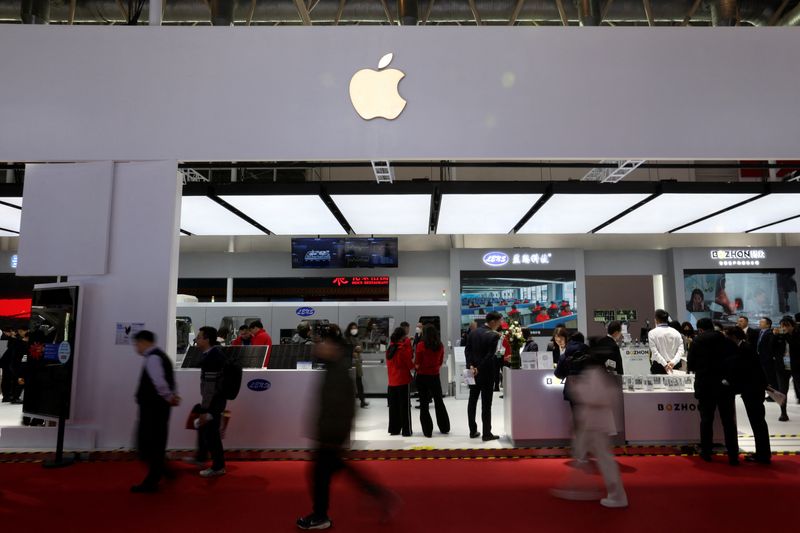

China consumers file antitrust complaint against Apple over app store practices

NegativeFinancial Markets

In a significant move, consumers in China have filed an antitrust complaint against Apple, alleging unfair practices in its App Store. This complaint highlights growing concerns over the dominance of major tech companies and their impact on competition. It matters because it could lead to increased scrutiny of Apple's business practices and potentially reshape the landscape for app distribution in China.

— Curated by the World Pulse Now AI Editorial System