BofA Says Reserve Managers May Cut French Bonds by €70 Billion

NegativeFinancial Markets

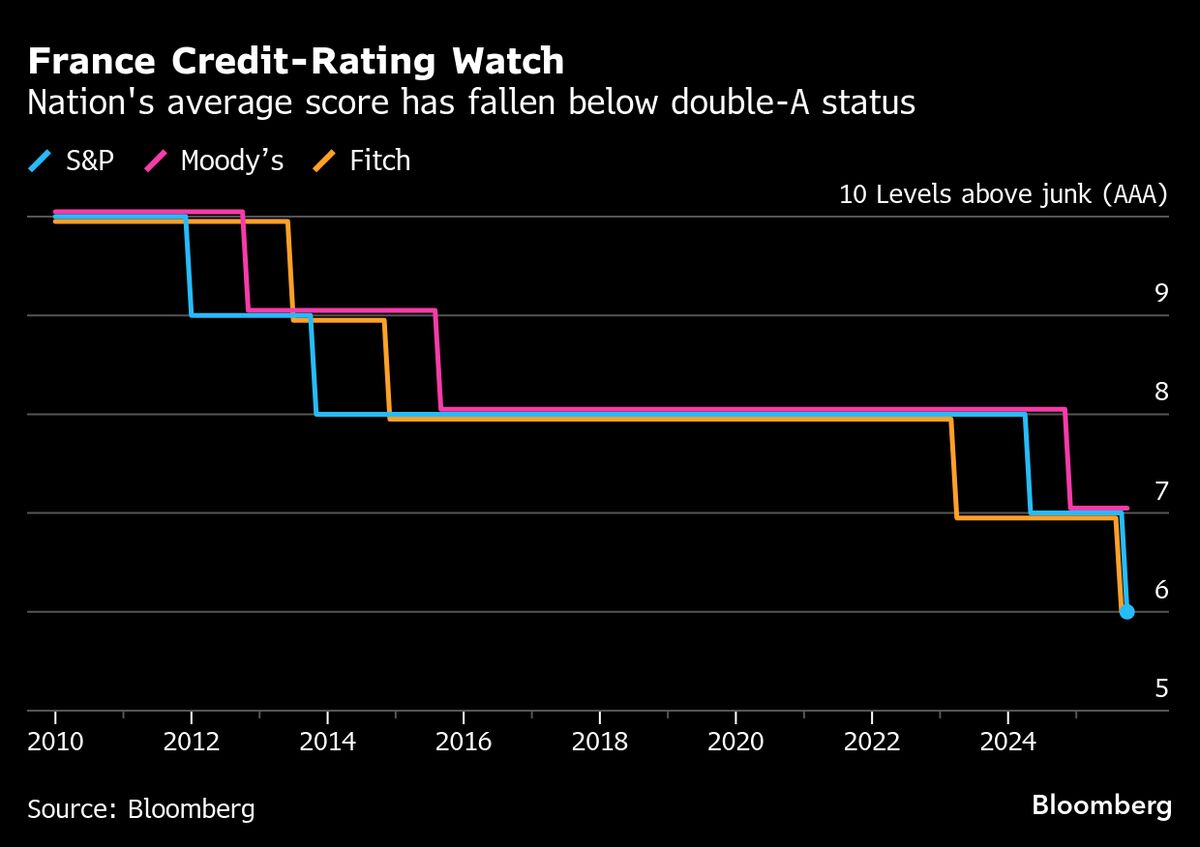

Bank of America analysts have warned that foreign reserve managers might cut their holdings of French government bonds by €70 billion, following recent credit-rating downgrades. This potential reduction is significant as it reflects growing concerns about the stability of French debt, which could impact investor confidence and the overall economy. Such a move could lead to increased borrowing costs for France and may affect its financial standing in the global market.

— Curated by the World Pulse Now AI Editorial System