Crypto Crash Concerns, Zac Prince Makes Return, Institutional Adoption | Bloomberg Crypto 10/15/2025

NeutralFinancial Markets

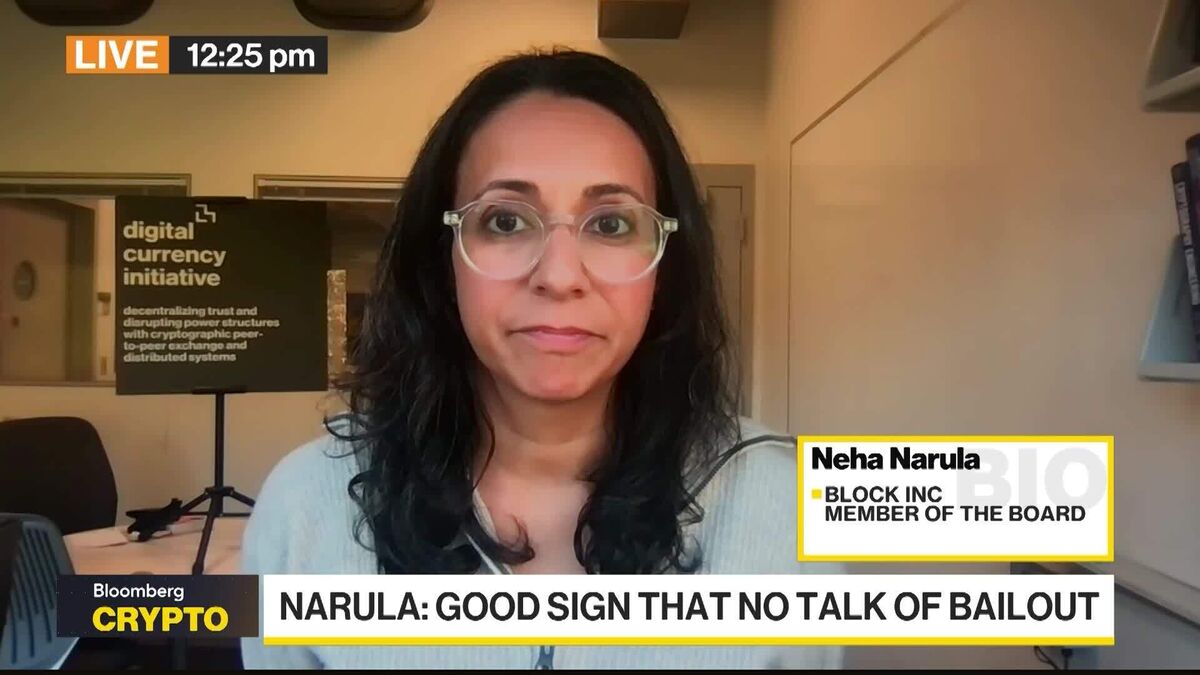

In a recent episode of Bloomberg Crypto, Zac Prince, the co-founder and former CEO of BlockFi, returned to discuss the current state of the cryptocurrency market amidst ongoing concerns about a potential crash. Alongside him was Neha Narula from MIT Media Lab, who shared insights on institutional adoption of digital currencies. This conversation is significant as it highlights the evolving landscape of decentralized finance and the challenges and opportunities that lie ahead for investors and institutions alike.

— Curated by the World Pulse Now AI Editorial System