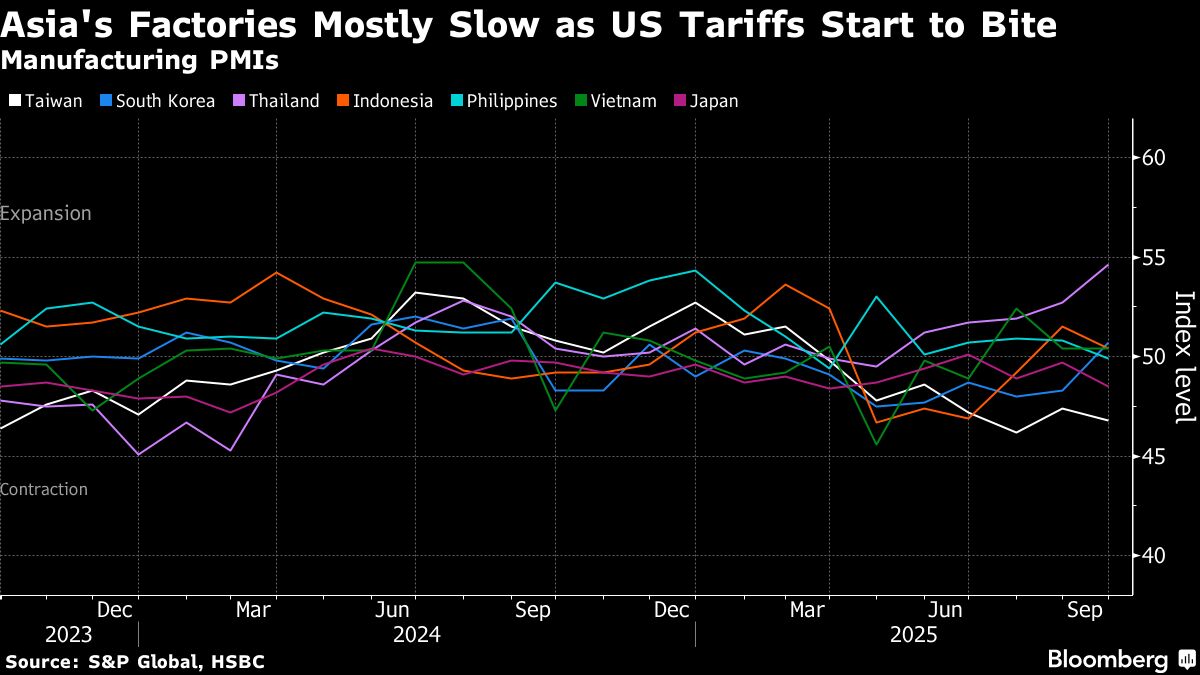

South Korea factory activity expands for first time in 8 months, PMI shows

PositiveFinancial Markets

South Korea's manufacturing sector has shown signs of recovery, with factory activity expanding for the first time in eight months, according to the latest Purchasing Managers' Index (PMI) data. This positive shift is significant as it indicates a potential turnaround in the economy, boosting confidence among businesses and investors alike. As the country navigates post-pandemic challenges, this growth could lead to increased production and job creation, marking a hopeful trend for the future.

— Curated by the World Pulse Now AI Editorial System