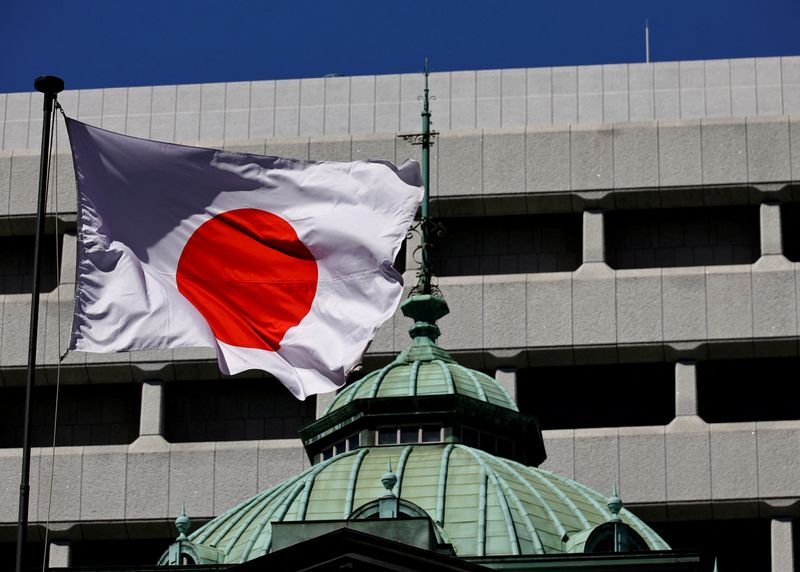

Japan’s Takaichi: BOJ decisions must align with government goals

NeutralFinancial Markets

Japan's Minister of Internal Affairs, Takaichi, emphasized the importance of aligning the Bank of Japan's (BOJ) decisions with government objectives. This statement highlights the ongoing dialogue between the government and the central bank regarding economic policies, particularly in the context of Japan's recovery from economic challenges. It matters because such alignment could influence monetary policy and impact the overall economic stability and growth of Japan.

— Curated by the World Pulse Now AI Editorial System