Factbox-Aligned Data Centers in spotlight after $40 billion sale to BlackRock, Nvidia-backed group

PositiveFinancial Markets

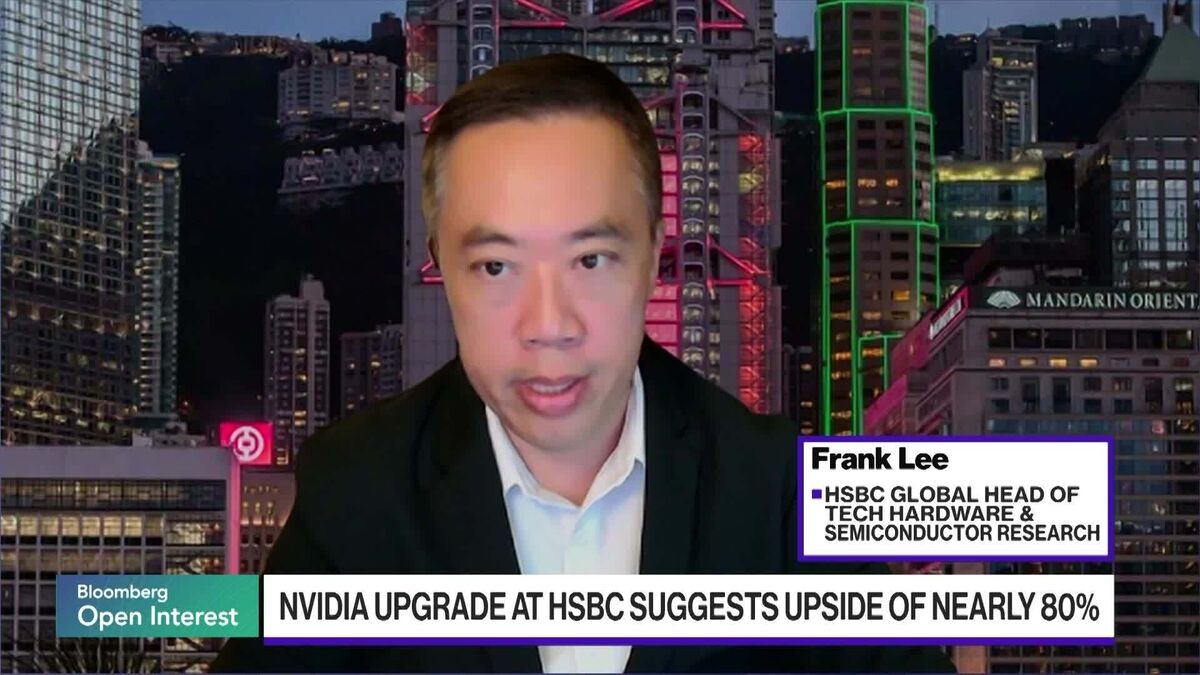

The recent $40 billion sale of aligned data centers to BlackRock and a Nvidia-backed group has sparked significant interest in the tech investment landscape. This deal highlights the growing demand for data infrastructure as businesses increasingly rely on digital solutions. It not only reflects confidence in the future of technology but also signals potential growth opportunities in the data center sector, which is crucial for supporting the digital economy.

— Curated by the World Pulse Now AI Editorial System