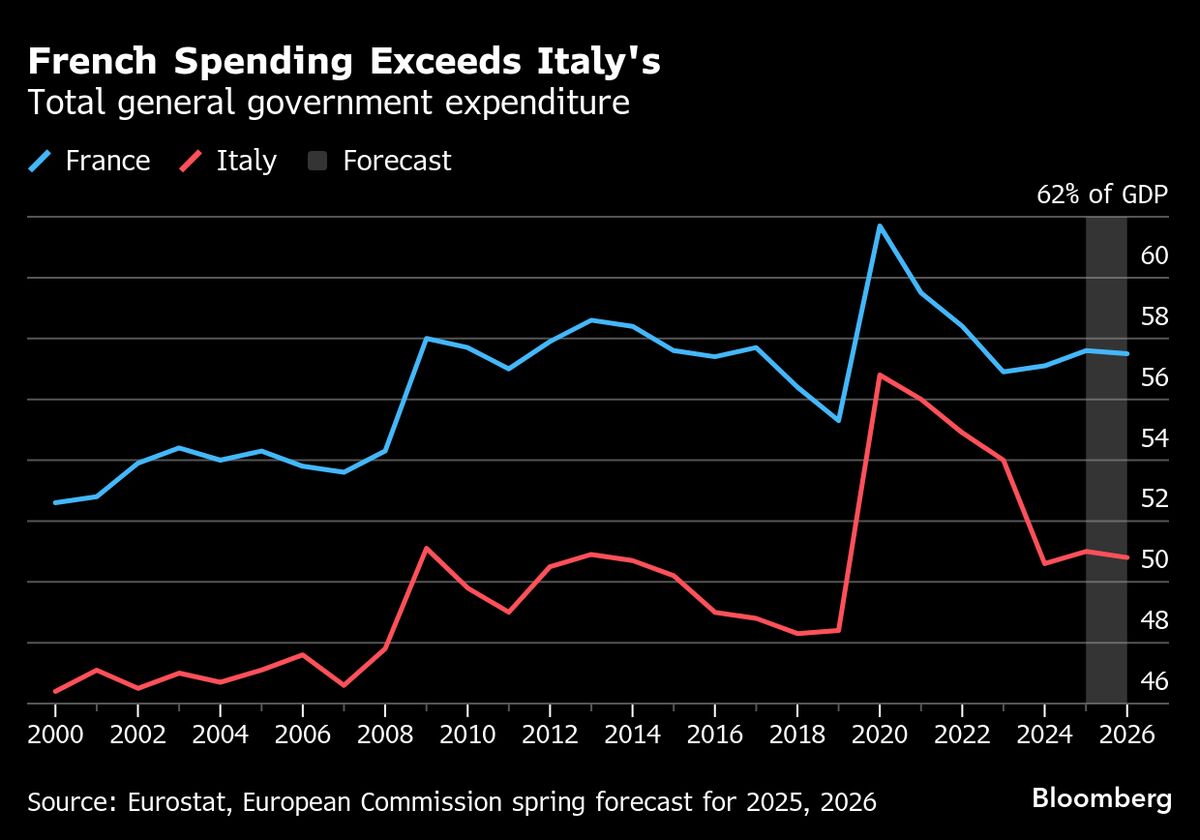

France Is Replacing Italy as Europe’s Poster Child of Fiscal Woe

NegativeFinancial Markets

France is currently facing a significant political crisis that has shifted its status to the euro area's fiscal flash-point, a role previously held by Italy. This change is crucial as it highlights the growing economic challenges within France, which could have broader implications for the stability of the eurozone. Observers are concerned about how this situation might affect investor confidence and economic recovery in the region.

— Curated by the World Pulse Now AI Editorial System