Regional Bank Issues May Lead to Consolidation: Sonders

NeutralFinancial Markets

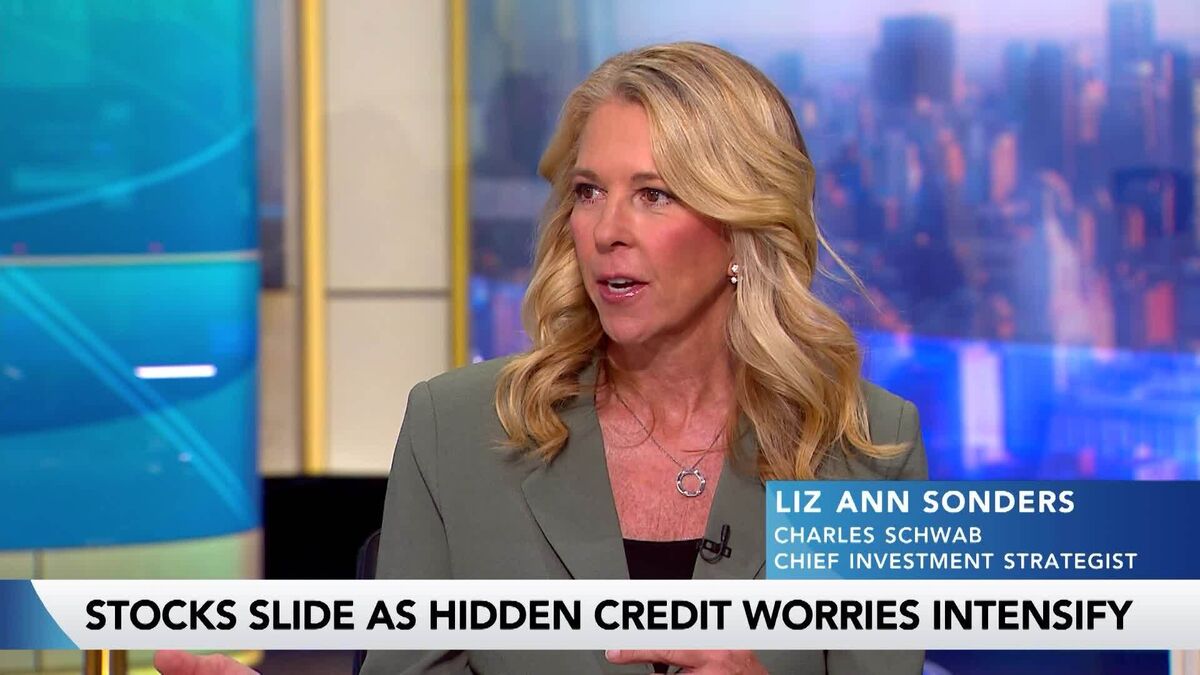

Liz Ann Sonders, the chief investment strategist at Charles Schwab, has highlighted the current strains in the regional banking sector. She suggests that investors should consider moving towards higher-quality investments to safeguard their portfolios. This insight is particularly relevant as it reflects ongoing challenges in the banking industry, prompting discussions about potential consolidation among regional banks.

— Curated by the World Pulse Now AI Editorial System