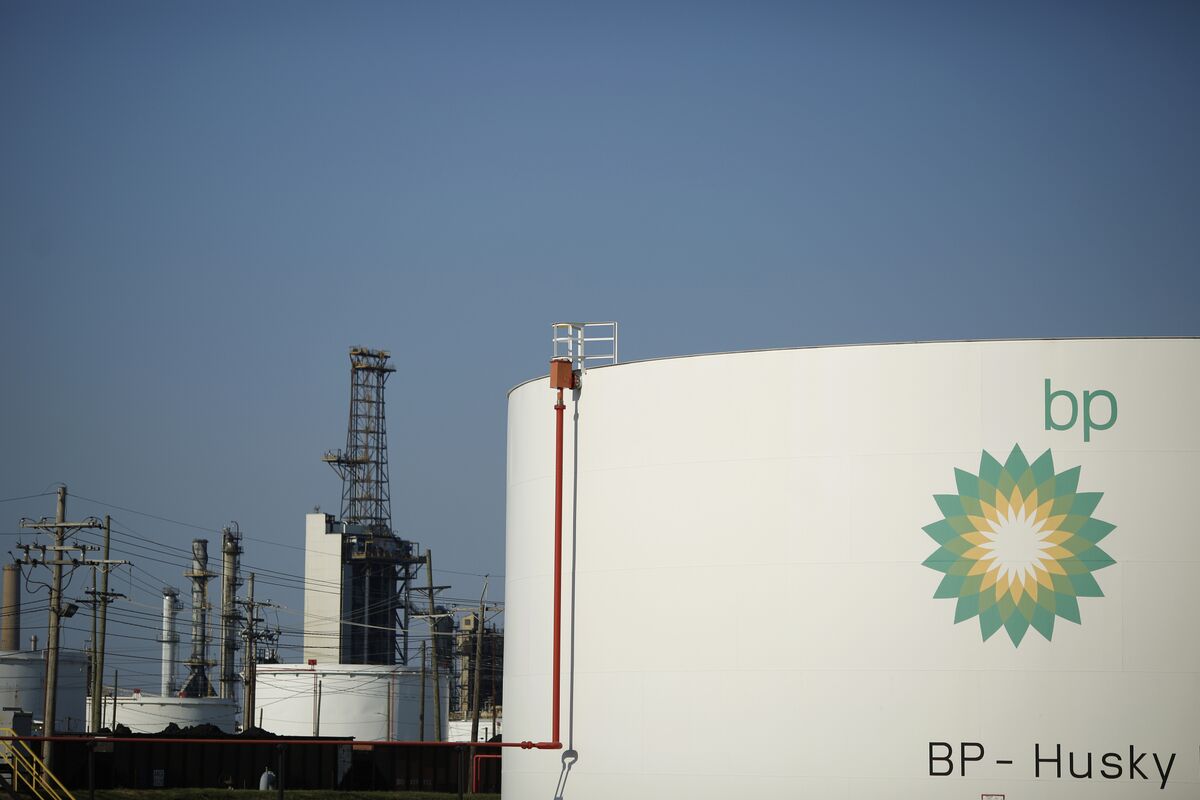

BP Expects Boost From Higher Upstream Production But Warns of Weak Oil Trading Result

NeutralFinancial Markets

BP is currently undergoing a strategic reset and reviewing its portfolio to strengthen its balance sheet in light of declining profitability and pressure from an activist investor. While the company anticipates a boost from higher upstream production, it also warns of weak results in oil trading. This situation is significant as it highlights the challenges faced by major oil companies in adapting to market pressures and investor expectations.

— Curated by the World Pulse Now AI Editorial System