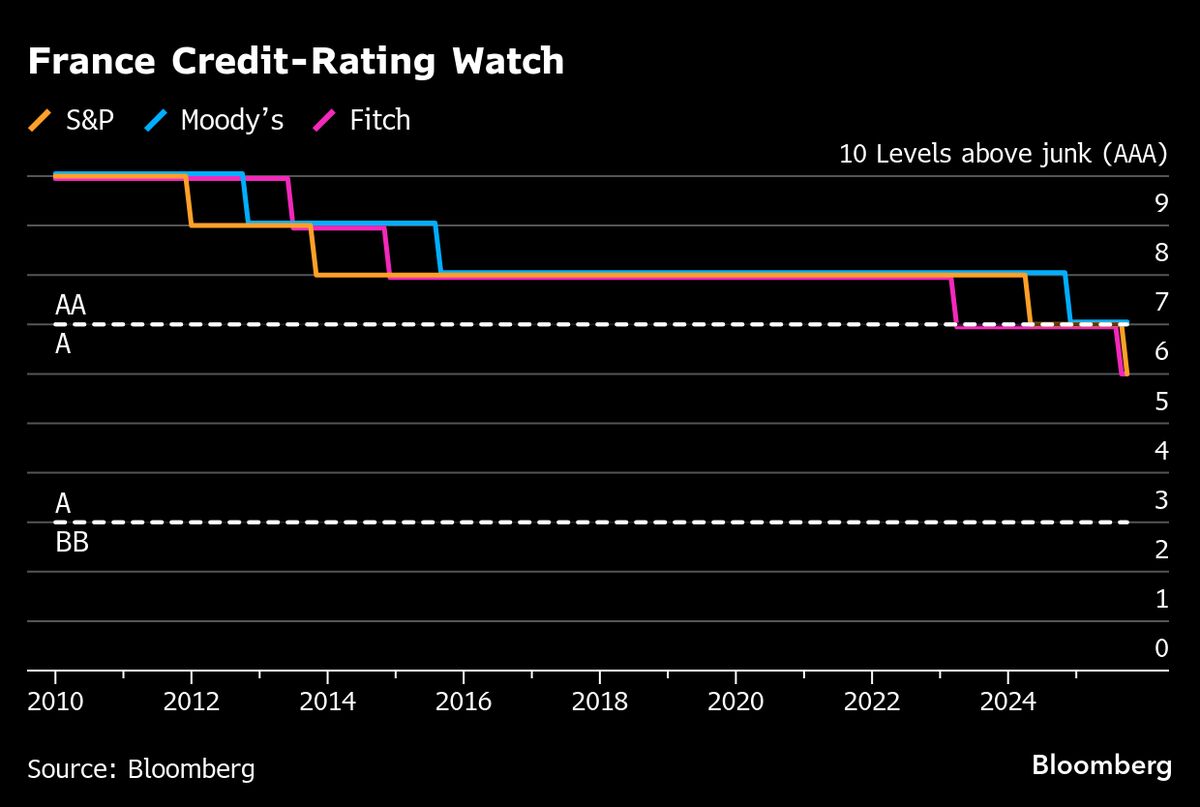

Crisis Budget: Rachel Reeves Poised to Shatter Labour’s Tax Pledge

NegativeFinancial Markets

Rachel Reeves, the Chancellor, is set to break Labour's longstanding tax pledge in the upcoming crisis budget. This move is significant as it reflects the party's shift in economic strategy amidst challenging financial circumstances. The decision could impact public perception and voter trust, raising questions about Labour's commitment to its promises and the implications for future elections.

— Curated by the World Pulse Now AI Editorial System