Occidental offloads chemicals unit in $9.7 billion deal with Berkshire to cut debt

PositiveFinancial Markets

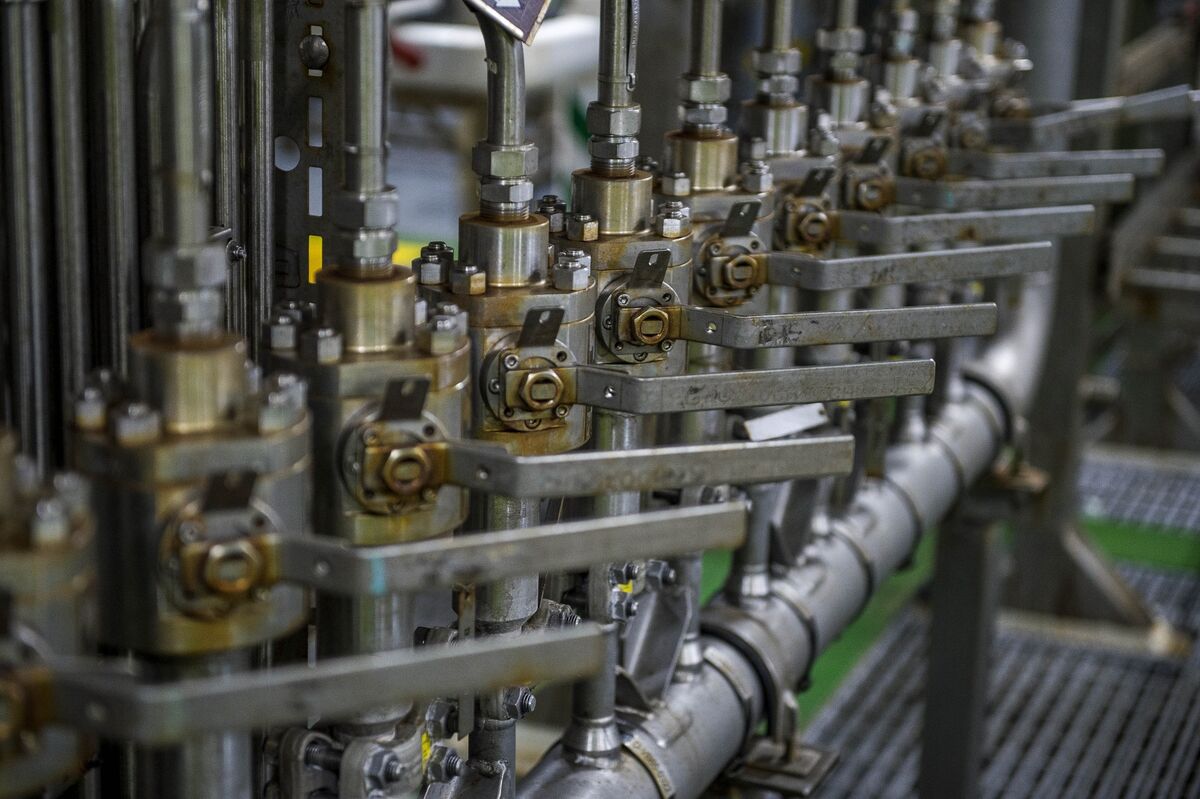

Occidental Petroleum has made a significant move by selling its chemicals unit to Berkshire Hathaway for $9.7 billion. This strategic decision is aimed at reducing the company's debt, which is crucial for its financial health and future growth. By offloading this division, Occidental can focus on its core operations and strengthen its balance sheet, which is a positive sign for investors and stakeholders alike.

— Curated by the World Pulse Now AI Editorial System