Morning Bid: Trade deal hope spurs risk rally

PositiveFinancial Markets

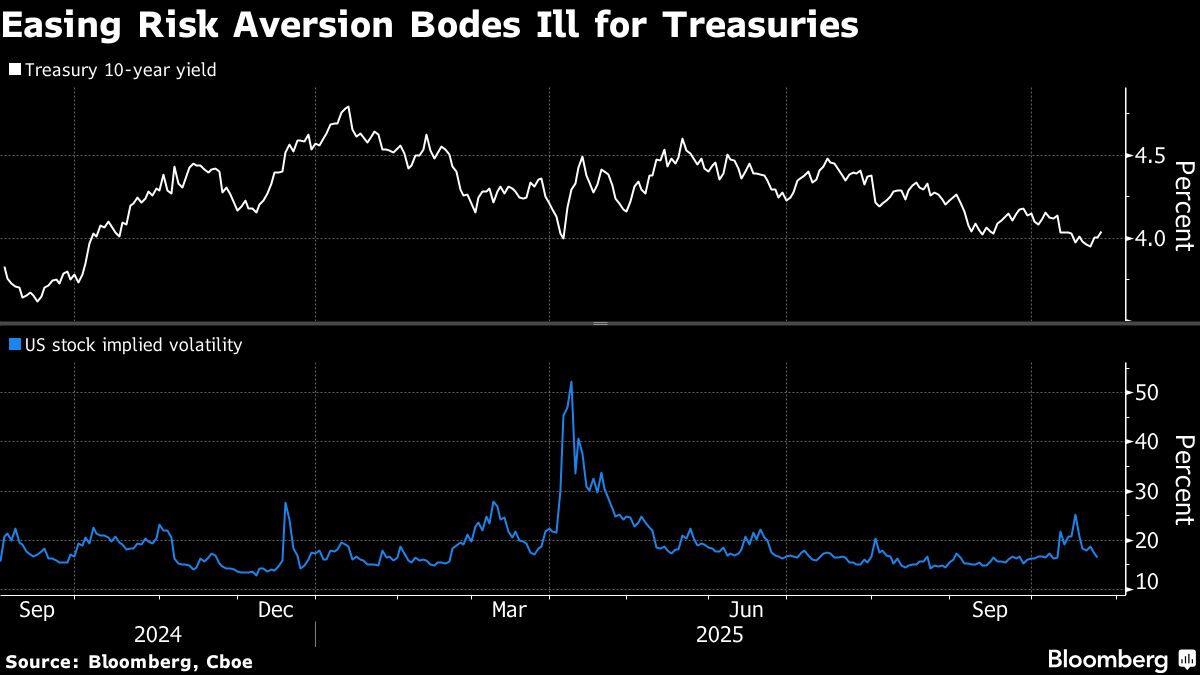

The recent optimism surrounding a potential trade deal has sparked a risk rally in the markets, encouraging investors to engage more actively. This surge in market confidence is significant as it reflects a broader hope for economic stability and growth, which could lead to increased investments and job creation. As negotiations progress, the implications of a successful agreement could resonate across various sectors, making this a crucial moment for the economy.

— Curated by the World Pulse Now AI Editorial System