Goldman Sees Higher Japan Bond Premium as Fiscal Worries Return

NeutralFinancial Markets

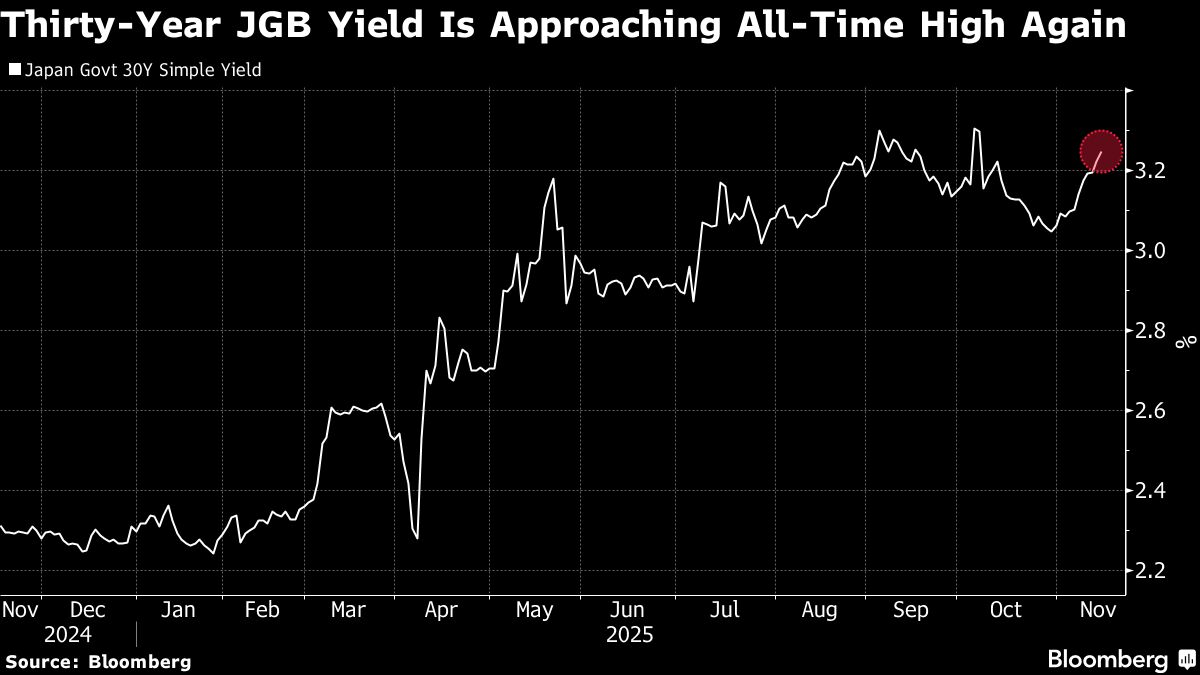

- Goldman Sachs has noted a return of Japan's fiscal risk premium, driven by investor apprehension over a larger

- The implications of this fiscal risk premium are significant for Goldman Sachs, as it may affect their investment strategies and forecasts related to Japan's economic stability and bond market performance.

- While there are no directly related articles to expand upon, the context of investor sentiment and fiscal challenges in Japan remains a critical theme in understanding market dynamics.

— via World Pulse Now AI Editorial System