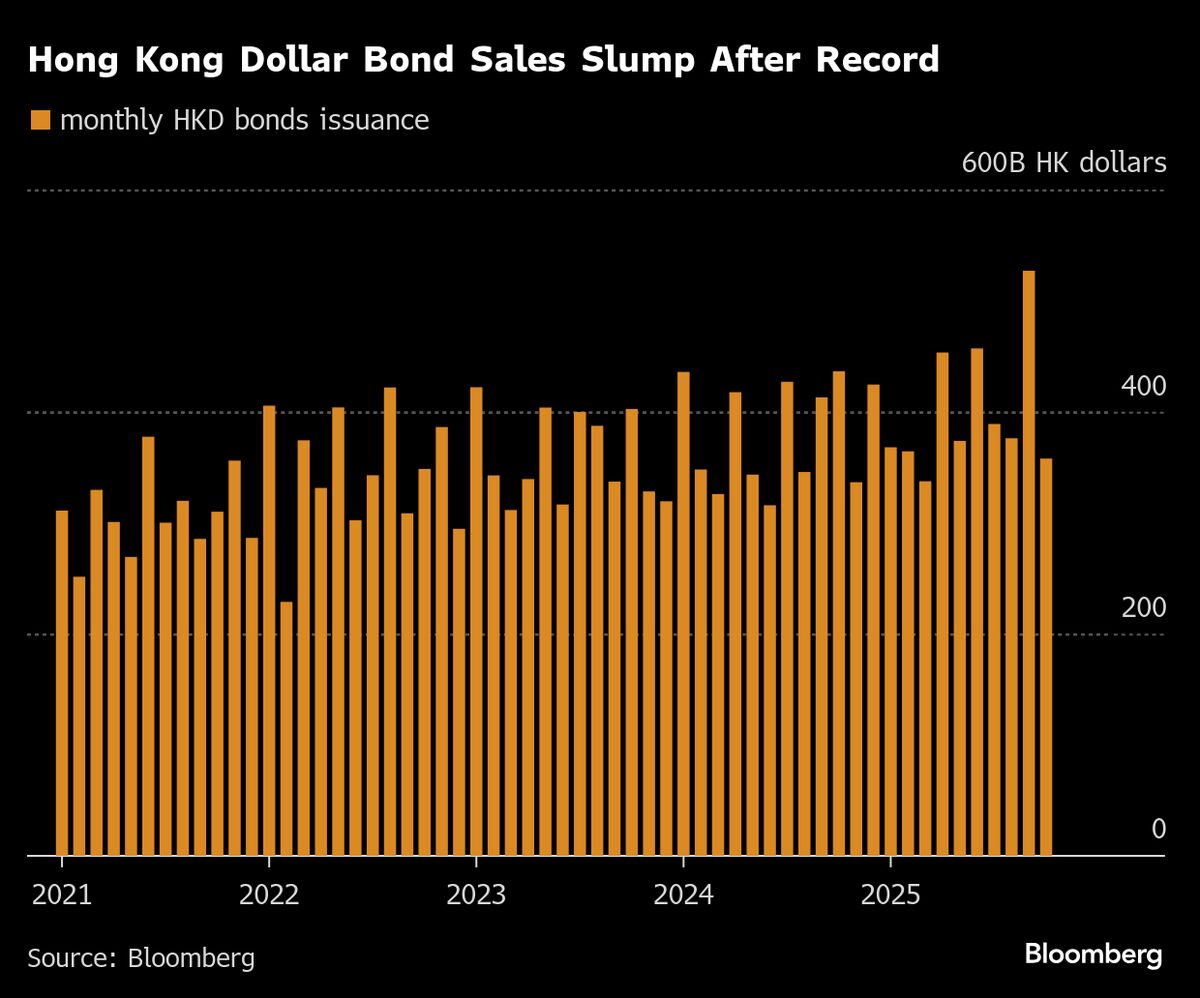

Hong Kong Dollar Bond Sales Slump as Borrowing Costs Stay High

NegativeFinancial Markets

Hong Kong's bond market is facing a downturn as the issuance of Hong Kong dollar-denominated bonds has significantly slowed down after a record month. This decline is largely attributed to high local interest rates, which have dampened the appetite for borrowing. This situation is concerning as it reflects broader economic challenges and could impact investment and financing options in the region.

— Curated by the World Pulse Now AI Editorial System