Stocks Whipsaw With Dow Erasing 700 Point Gain As Fed Rate Cut Odds Drop

PositiveFinancial Markets

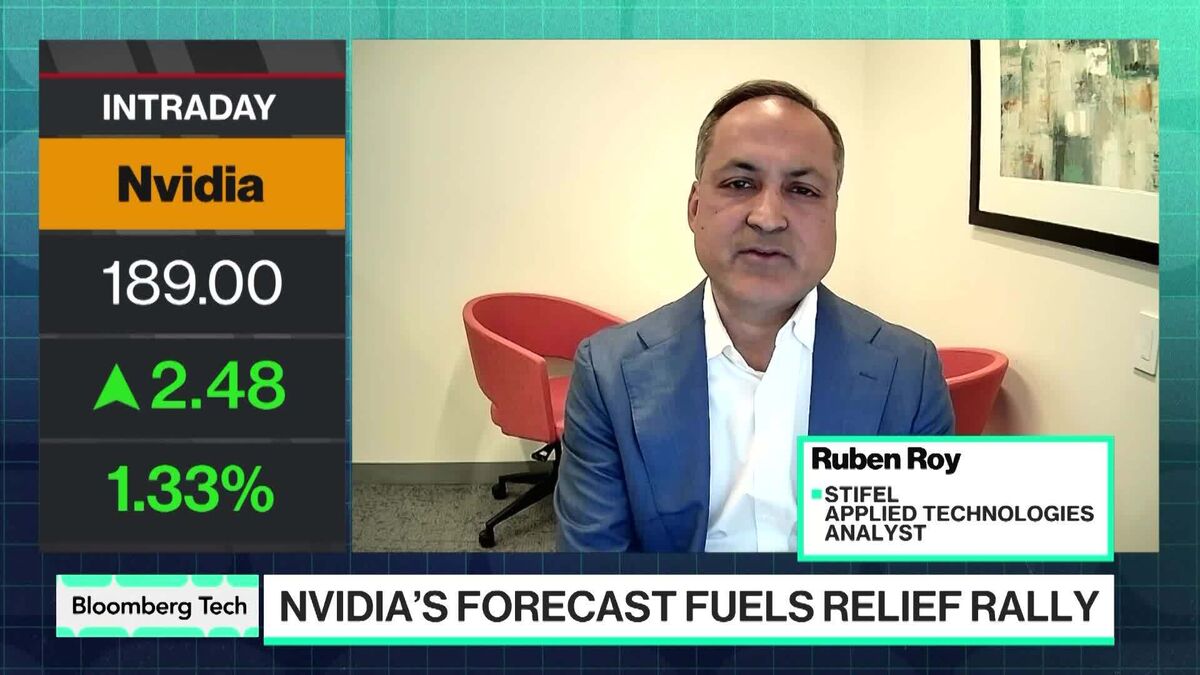

- Nvidia's earnings report surpassed forecasts, easing market fears regarding a potential AI bubble and contributing to a positive shift in stock sentiment.

- This strong financial performance is crucial for Nvidia, as it reinforces its position as a leader in the AI sector and boosts investor confidence amid previous concerns about sustainability.

- The broader market context reflects a growing optimism in tech stocks, with Nvidia's success serving as a bellwether for the health of the AI industry and its potential for continued growth.

— via World Pulse Now AI Editorial System