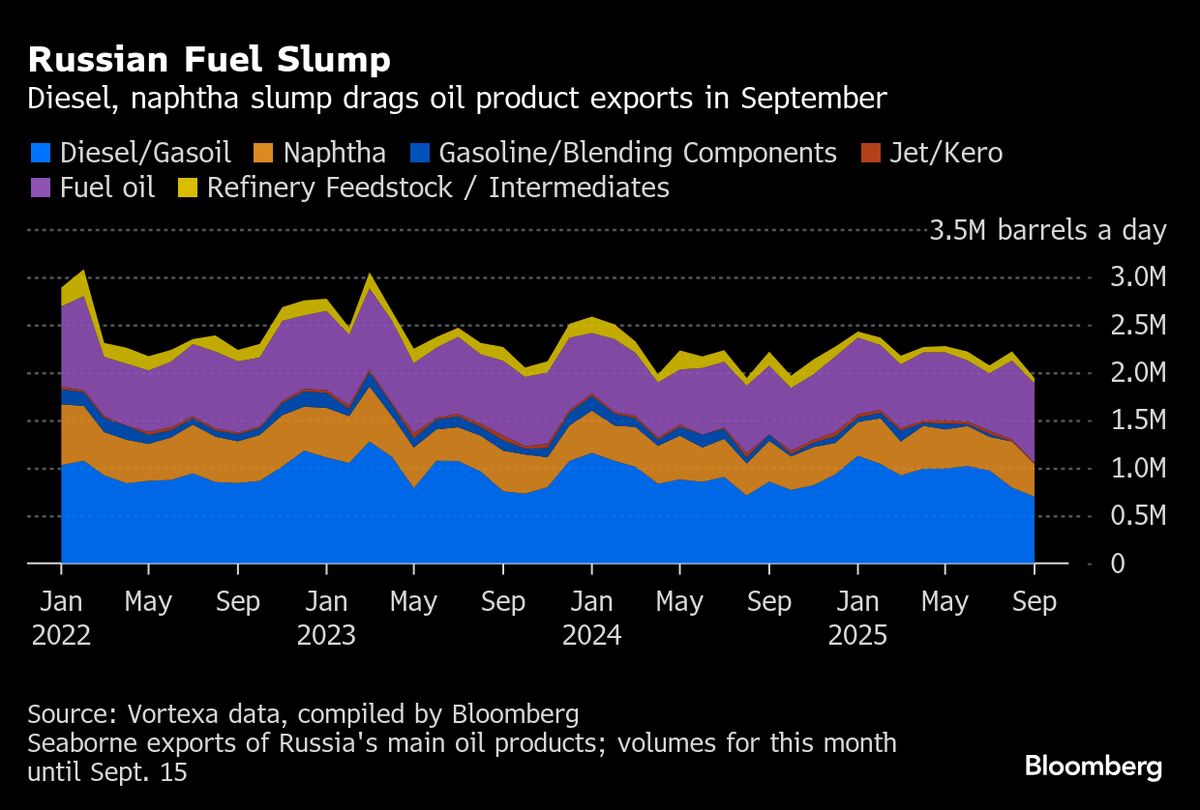

Russian Fuel Flows Slump as Plants Hit, Home Demand Prioritized

NegativeFinancial Markets

Russian oil product exports have plummeted to a wartime low due to increased Ukrainian drone strikes targeting refineries, which have significantly reduced output. This shift in focus towards meeting domestic demand highlights the ongoing impact of the conflict on Russia's energy sector and raises concerns about the stability of global oil markets.

— Curated by the World Pulse Now AI Editorial System