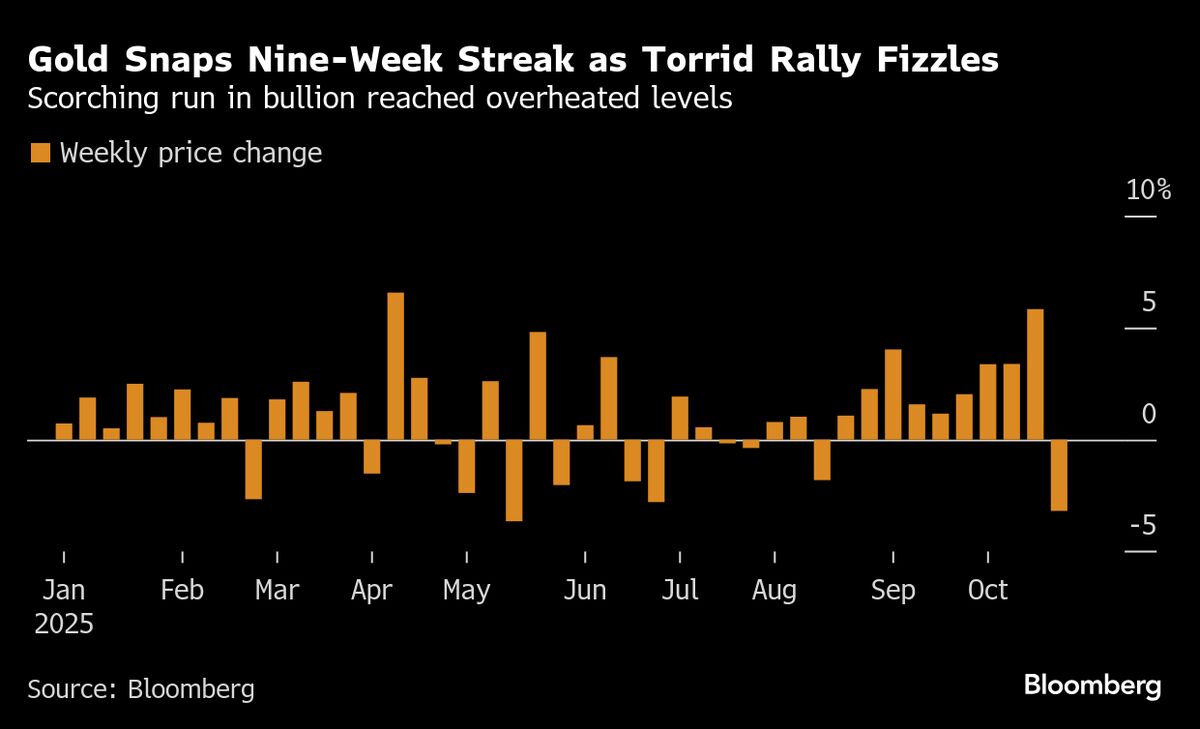

Gold to Snap Nine-Week Winning Streak as Heat Comes Out of Rally

NegativeFinancial Markets

Gold is poised to end its impressive nine-week winning streak due to a significant correction as traders reevaluate a recent rally that pushed prices into overheated territory. This shift is important as it reflects changing market dynamics and could influence investment strategies moving forward.

— Curated by the World Pulse Now AI Editorial System